Asset management firm Grayscale has released its forward-looking market outlook for 2026, and its message on Bitcoin is notably optimistic. According to the firm, a combination of rising institutional demand, macroeconomic pressures, and improving regulatory clarity in the United States could push Bitcoin to a new all-time high during the first half of 2026. Grayscale’s analysts believe the crypto market may be entering a renewed growth phase that looks structurally different from previous cycles.

Why the First Half of 2026 Matters for Bitcoin

Grayscale highlights the first six months of 2026 as a critical window for Bitcoin’s next major move. The firm argues that investors are increasingly searching for alternative stores of value as traditional financial systems face mounting strain. At the same time, clearer rules for digital assets in the U.S. are reducing uncertainty, making it easier for large institutions to allocate capital to Bitcoin.

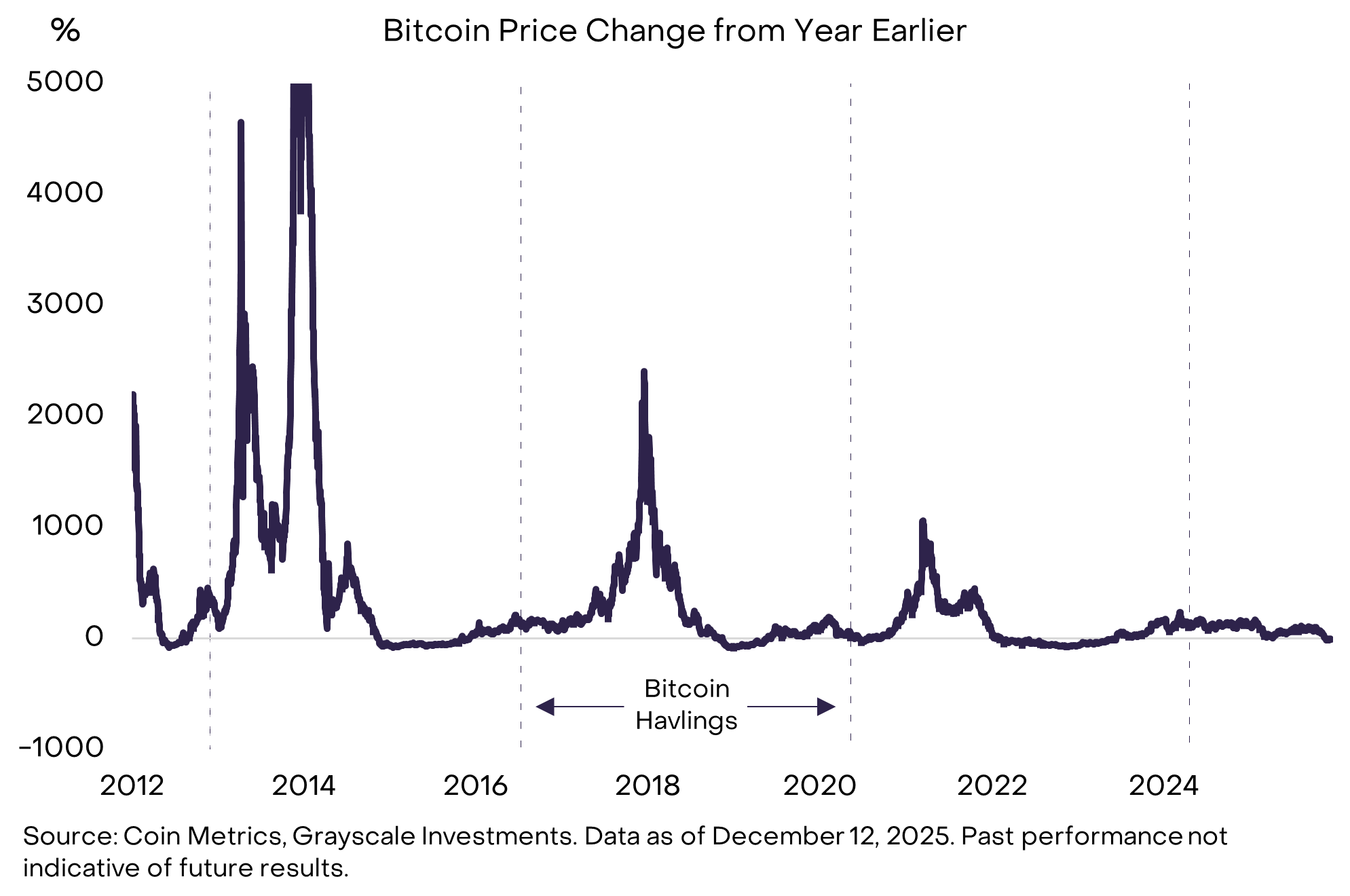

An important point in Grayscale’s analysis is the weakening relevance of the so-called Bitcoin “four-year cycle.” Rather than price action being dominated by halving-driven patterns, the firm suggests Bitcoin is transitioning into an asset shaped more by macro forces, capital flows, and long-term adoption dynamics.

Macro Pressures Are Strengthening the Bitcoin Narrative

One of the key drivers behind Grayscale’s bullish outlook is the global macroeconomic environment. Rising public-sector debt and persistent inflation risks are increasing concerns around fiat currency debasement. In such a landscape, scarce digital assets like Bitcoin — and to a lesser extent Ethereum — are becoming more attractive as long-term portfolio components.

Grayscale notes that as long as confidence in fiat currencies continues to erode, demand for crypto assets as alternative value stores is likely to keep growing. This structural demand, rather than short-term speculation, is seen as a major factor supporting higher valuations.

Regulation Is Unlocking Institutional Capital

Regulatory developments in the U.S. play a central role in Grayscale’s forecast. The approval of spot Bitcoin ETFs, progress on stablecoin legislation through the GENIUS Act, and a shift toward more constructive engagement between regulators and the crypto industry have all contributed to a more favorable environment.

Looking ahead, Grayscale expects bipartisan crypto market structure legislation to emerge in 2026. Such a move could firmly embed blockchain-based finance within U.S. capital markets and further accelerate institutional participation.

Key Crypto Themes to Watch in 2026

Beyond Bitcoin’s price outlook, Grayscale identifies several investment themes likely to define 2026. These include rapid growth in the stablecoin market, an inflection point for real-world asset tokenization, and renewed expansion in decentralized finance — particularly lending protocols. Staking is also expected to become a standard component of crypto investment strategies.

In contrast, narratives such as quantum computing risks and digital asset treasuries are viewed as unlikely to significantly influence market valuations in the near term.

Overall, Grayscale’s outlook suggests that 2026 could mark a more mature, institutionally driven phase for Bitcoin — one that may culminate in a new all-time high sooner than many expect.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.