Kevin Hassett, one of the strongest contenders for the next Chair of the U.S. Federal Reserve, has moved into the spotlight with clear remarks emphasizing the central bank’s independence. Addressing growing speculation around political influence, Hassett stated that President Donald Trump’s views on interest rates would not carry decisive weight if he were to lead the Fed.

Fed Independence Takes Center Stage

In recent public comments, Hassett acknowledged that President Trump holds firm and well-developed opinions on economic policy and interest rates. However, he stressed that the Federal Reserve’s mandate requires decisions to be made independently of political preferences. According to Hassett, interest rate policy should emerge from collective judgment within the Federal Reserve System, shaped by the Board of Governors and the Federal Open Market Committee (FOMC), rather than by directives from any single political authority.

This stance comes amid renewed debate after Trump suggested that presidents should have more influence over monetary policy. Hassett’s response positions him as a defender of institutional credibility, reinforcing the Fed’s role as a data-driven and consensus-based policymaker.

A Dovish Profile with Clear Boundaries

Market participants broadly view Hassett as a dovish figure. He is widely associated with a growth-oriented approach to monetary policy and has shown openness to meaningful rate cuts if economic conditions warrant them. This reputation has fueled expectations that a Hassett-led Fed could lean toward supporting economic expansion, even if inflation risks remain present.

That said, Hassett has drawn a clear distinction between policy flexibility and political alignment. While his economic views may partially overlap with Trump’s calls for aggressive rate reductions, he has consistently underlined that monetary decisions must be anchored in macroeconomic indicators rather than political pressure.

The Fed Chair Race Gains Momentum

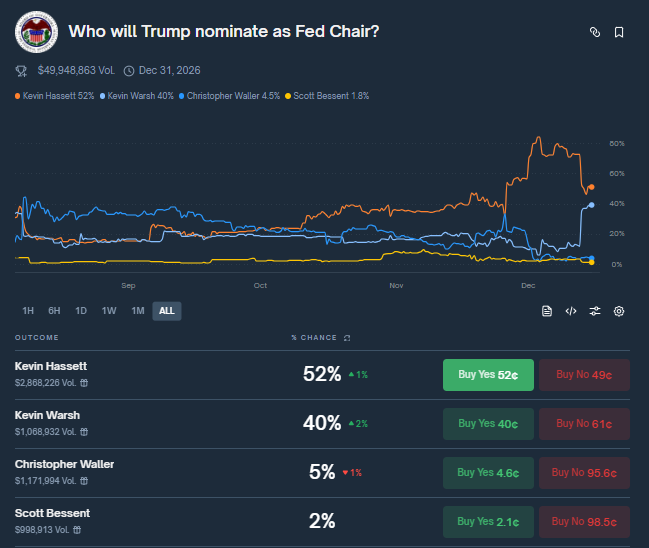

Prediction markets have added another layer of intrigue to the unfolding leadership transition. Current odds place Hassett as the frontrunner for the Fed chair position, with a probability exceeding 50%. Former Federal Reserve Governor Kevin Warsh follows closely behind, having seen a sharp rise in expectations after a recent meeting with Trump.

With the current Fed Chair’s term scheduled to conclude on May 15, the timeline for a decision is becoming increasingly relevant for global markets.

Implications for Bitcoin and Risk Assets

For investors in Bitcoin and other risk-sensitive assets, the prospect of future Fed rate cuts remains a critical driver of sentiment. Expectations of looser monetary policy are often associated with increased liquidity and higher risk appetite. Hassett’s dovish reputation supports these hopes, while his emphasis on central bank independence offers reassurance of policy stability.

As the Fed leadership question moves closer to resolution, markets will continue to assess not only who takes the helm, but also how their philosophy may shape the next phase of U.S. monetary policy and global financial conditions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.