BitMEX founder Arthur Hayes argues that developments in Japan’s financial system could have a far greater impact on Bitcoin than many market participants currently expect. According to Hayes, growing pressure on the Japanese yen combined with rising Japanese government bond (JGB) yields could trigger a broader liquidity chain reaction — one that may ultimately benefit Bitcoin.

Japan Under Dual Financial Stress

Japan is facing a rare and challenging combination of macroeconomic pressures. On one side, the yen continues to weaken against the US dollar. On the other, yields on Japanese government bonds are moving higher. Together, these signals suggest that investor confidence in Japan’s debt market may be starting to erode.

This dynamic does not remain confined within Japan’s borders. Hayes points out that Japanese institutional investors, long known as major holders of US Treasuries, could be incentivized to sell US bonds and rotate capital back into higher-yielding domestic debt. Such a shift could introduce volatility into the US Treasury market and tighten global liquidity conditions.

Why Central Bank Intervention May Be Inevitable

In Hayes’ view, a scenario where both the yen and the JGB market come under severe stress would almost certainly force central banks to act. Either the Bank of Japan (BOJ), the Federal Reserve, or both could step in to stabilize markets through monetary expansion.

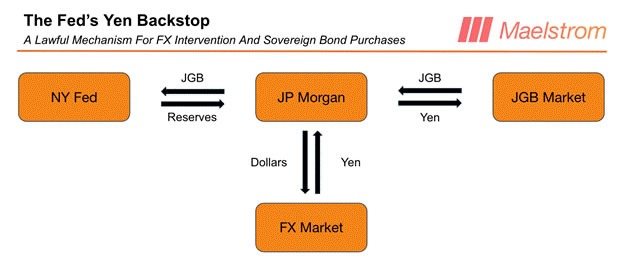

Hayes outlines a potential intervention framework in which the Federal Reserve creates dollar liquidity via large US banks, exchanges those dollars for yen to support the Japanese currency, and then uses the yen to purchase Japanese government bonds. This process would help cap JGB yields while strengthening the yen, but it would also expand the Fed’s balance sheet under foreign-currency-denominated assets.

The Bitcoin Connection

For Bitcoin, this type of monetary response is highly relevant. Hayes emphasizes that Bitcoin has historically responded positively to periods of aggressive liquidity injection and balance sheet expansion by central banks. A return to money printing, even if initially targeted at stabilizing bond and currency markets, could spill over into risk assets.

According to Hayes, Bitcoin’s prolonged sideways price action reflects a lack of fresh liquidity. A renewed wave of monetary expansion could provide the catalyst needed to push Bitcoin out of its current range and into a new pricing regime.

Watching the Fed’s Balance Sheet Closely

Hayes has made it clear that he is closely monitoring the Federal Reserve’s weekly H.4.1 balance sheet reports for confirmation of such intervention. Until clear evidence of renewed money creation appears, he remains cautious about increasing risk exposure.

A Broader Macro Implication

With the US dollar index hovering near multi-year lows, the global monetary system appears increasingly fragile. Hayes believes that any disruption in Japan’s bond market could accelerate central bank responses worldwide, indirectly reinforcing Bitcoin’s appeal as a scarce, non-sovereign asset.

In short, a potential crisis in Japanese government bonds may not remain a regional issue. If it forces global liquidity back into expansion mode, Bitcoin could emerge as one of the key beneficiaries.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.