Arthur Hayes, a well-known figure in the crypto industry and co-founder of BitMEX, has once again outlined a bullish case for Bitcoin. According to Hayes, a potential $572 billion wave of liquidity originating from Washington could lay the groundwork for a renewed surge in risk assets. His thesis centers on developments within US Treasury cash management and bond buyback operations.

Where Could the Liquidity Come From?

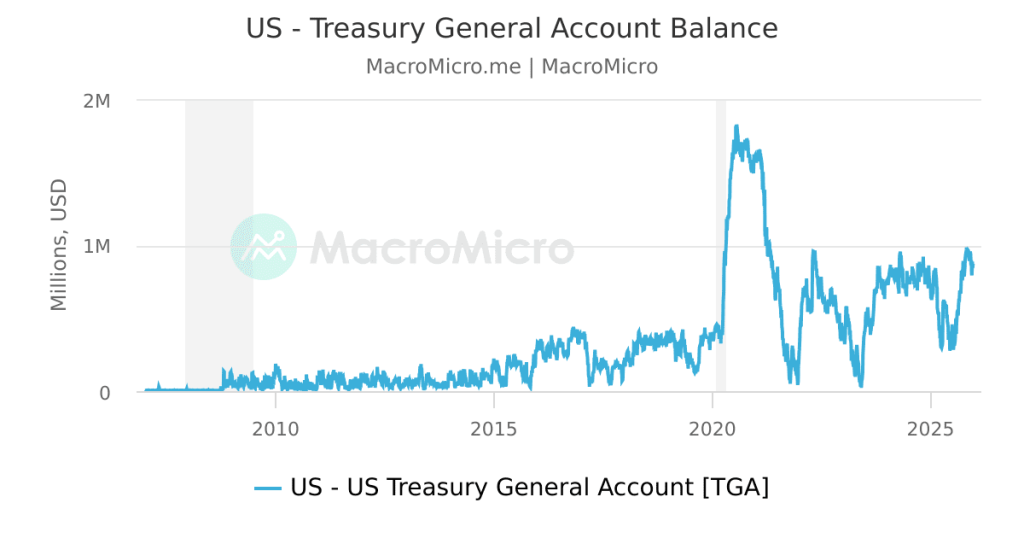

At the heart of Hayes’ argument is the US Treasury General Account (TGA), essentially the government’s primary cash account held at the Federal Reserve. When balances in the TGA are elevated, funds remain parked and largely outside the broader financial system. As the balance declines through government spending, liquidity flows back into banks and markets.

Currently, the TGA balance stands near $750 billion, while the Treasury’s guidance suggests a target closer to $450 billion. That gap implies roughly $301 billion could be released into the financial system as the balance is drawn down.

In addition, the Treasury has initiated bond buybacks aimed at improving market functioning by repurchasing older debt. Hayes estimates that, at the current pace, these buybacks could inject another $271 billion annually. Combined, these two channels represent a potential liquidity boost of approximately $572 billion.

A Form of “Stealth Stimulus”?

Although this process is not formally labeled as monetary easing, Hayes argues that its practical effect may resemble stimulus. While the Federal Reserve maintains a tight policy stance in its messaging, Treasury operations are simultaneously increasing cash circulation. In liquidity-driven markets, capital flows often carry more weight than rhetoric.

Historically, periods of expanding liquidity have tended to support risk assets, including cryptocurrencies.

What Does This Mean for Bitcoin?

Hayes believes the most difficult phase for crypto may already be over. He points out that Bitcoin has historically shown a strong relationship with global liquidity conditions. When US dollar supply expands, scarce assets such as BTC often experience upward pressure.

He also notes that extreme funding rates suggest crowded short positioning in the market. If fresh liquidity enters the system while traders are heavily positioned to the downside, a sharp short squeeze could follow. In that scenario, Hayes sees room for Bitcoin to revisit all-time highs and potentially approach the $100,000 level.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.