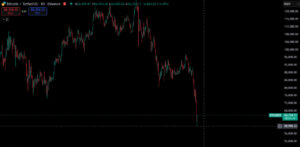

As selling pressure intensified across the cryptocurrency market, Bitcoin fell below the $63,000 level, marking its lowest prices since October 2024. With an intraday decline of up to 14%, Bitcoin dropped as low as $59,995, clearly reflecting rising market volatility and a strong risk-off sentiment. With this sharp pullback, all gains achieved during the rally that began after Donald Trump’s election victory have been wiped out, while investor sentiment has weakened significantly.

Why Did Bitcoin Fall So Sharply?

According to analysts, the current decline cannot be attributed to a single factor. Rising geopolitical risks, an increasing risk-off trend in global markets, outflows from spot Bitcoin ETFs, and the liquidation of highly leveraged positions combined to create a self-reinforcing sell-off spiral. The simultaneous activation of these factors made the pullback both faster and more severe.

The downtrend, which gained momentum from mid-January, deepened especially due to the forced closure of leveraged long positions. Additionally, fund managers being compelled to sell assets to meet rising redemption demands further amplified selling pressure. Analysts note that this process weakened market sentiment and pushed investors toward more defensive positioning.

Macro Uncertainty Is Fueling Market Volatility

Bitcoin’s sharp decline is not driven solely by internal crypto-market dynamics; macroeconomic uncertainty is also playing a major role. Political developments in the United States are dampening global risk appetite and creating cross-market effects on both traditional and crypto assets.

In particular, President Donald Trump’s nomination of Kevin Warsh as a candidate for Fed chair has generated mixed expectations in the markets. Warsh’s past experience in central banking has heightened uncertainty around future interest-rate and monetary policy trajectories. This has fueled expectations of a stronger dollar and tighter liquidity conditions, further weakening risk appetite.

Another major source of macro uncertainty stems from geopolitical tensions, especially those involving the U.S., the Middle East, and Iran. These tensions have strengthened the global “risk-off” mood, causing risky assets like Bitcoin to decline alongside equities while demand shifts toward perceived safe havens. Such global risk events impact not only Bitcoin but also cause price volatility in precious metals like gold and silver, reinforcing the broader flight to safety across global financial markets.

Liquidations and Market Psychology

According to recent data, Bitcoin briefly fell to $60,000 on Thursday night before rebounding toward $64,000 on buying interest. However, this rapid price action indicates that volatility remains extremely high. Sharp moves within short timeframes highlight the fragility of investor sentiment.

According to Coinglass data, liquidations over the past 24 hours reached striking levels:

- Total liquidations: $2.56 billion

- Long liquidations: $2.11 billion

These figures show that the decline was largely driven by forced liquidations of excessively leveraged long positions. During the same period, the Crypto Fear & Greed Index fell to 9, entering “extreme fear” territory and hitting one of its lowest historical levels. This signals a severe deterioration in overall market risk perception.

Analysts emphasize that such extreme fear phases typically coincide with high volatility, and that a reduction in liquidation pressure is critical for market stabilization.

ETF Outflows and Institutional Pressure

Spot Bitcoin ETFs, which supported Bitcoin’s price throughout 2025, have seen a clear reversal in recent weeks. Market data points to weakening institutional risk appetite:

- Approximately $690 million in net outflows over the past week

These ETF outflows suggest that institutional investors are reducing short-term risk exposure and adopting more cautious portfolio positioning. Analysts note that ETF outflows not only pressure prices directly but also negatively affect market sentiment, accelerating sell-offs.

“Catching a Falling Knife” Mentality Takes Over

Rachael Lucas highlights a clear shift in investor behavior. According to Lucas:

“Traders are no longer trying to catch falling knives. Capital preservation has become the priority.”

This mindset is leading to lower trading volumes in short-term strategies and causing rebound attempts to be met with selling. Similarly, Ryan Rasmussen of Bitwise Asset Management describes current market conditions as a classic “capitulation phase,” noting that selling momentum remains strong.

Analysts stress that holding the $58,000–$60,000 range is critical for a potential recovery. However, without a clear improvement in market sentiment, a strong and sustainable upside move appears unlikely. As a result, high volatility is expected to persist in the short term.

Assessment

This sharp decline in Bitcoin once again underscores that the crypto market remains a high-risk asset class. While ETF outflows, liquidations, and macro uncertainty are increasing short-term pressure, history shows that such deep pullbacks can also create opportunity zones for long-term investors. Still, analysts emphasize that time and clear catalysts are needed for the market to stabilize.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.