Large on-chain transfers often capture the attention of crypto investors, especially when they originate from project teams. A recent movement from a Hyperliquid-linked wallet has sparked new discussions within the community. The team shifted approximately $90 million worth of unstaked HYPE tokens to the spot market, raising questions about short-term market implications and overall sentiment toward the project.

2.6 Million HYPE Tokens Shifted to the Spot Market

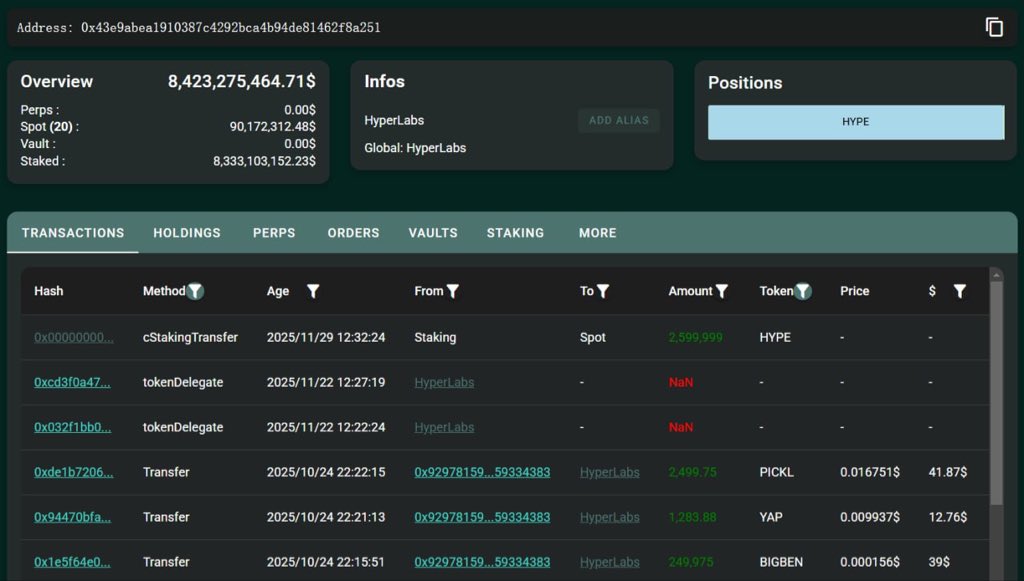

Blockchain data shows that the Hyperliquid team’s wallet, identified as 0x43…a251, transferred 2.6 million HYPE tokens out of staking and into the spot market. The total value of this movement is estimated at $90.18 million.

A token transfer of this size naturally leads to speculation. Since it was directed toward the spot market, some investors interpret it as a potential signal of increased short-term selling pressure. Historically, large token movements from project-controlled wallets can contribute to temporary volatility, even if they do not necessarily signal a negative long-term outlook.

240 Million HYPE Tokens Remain Staked

Despite this notable transfer, the wallet continues to hold a substantial amount of staked tokens. According to on-chain records, the same wallet still contains 240 million staked HYPE, valued at approximately $8.36 billion.

This detail is important because it shows that the transferred amount represents only a small fraction of the team’s total holdings. For many observers, such a massive remaining staked balance indicates that the team still maintains strong long-term confidence in the ecosystem.

Potential Market Impact and Investor Expectations

Significant token movements like this are closely monitored, as they can influence investor behavior and short-term price action. The latest transfer may lead to:

-

Increased liquidity in spot markets,

-

Short-term volatility due to uncertainty,

-

Heightened attention to the team’s future on-chain activities.

Still, the fact that the vast majority of tokens remain locked in staking suggests a continued commitment from the team and may help stabilize long-term sentiment.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.