Despite price fluctuations in the cryptocurrency market, institutional investors’ interest in Bitcoin remains strong. Ki Young Ju, CEO of on-chain data analytics firm CryptoQuant, stated that institutional purchases have continued robustly despite recent market downturns. According to shared data, institutional wallets have accumulated hundreds of thousands of BTC over the past year.

Bitcoin Demand Persists Amid Rising Geopolitical Risks

Rising geopolitical tensions in global markets have pushed investors toward safe-haven assets, with gold and silver prices hitting consecutive record highs. Despite this environment, Ki Young Ju emphasizes that institutional Bitcoin purchases are continuing steadily rather than weakening. Experts suggest that Bitcoin’s “digital gold” narrative has solidified its role in institutional portfolios.

Institutional Wallets Added 577,000 BTC in the Past Year

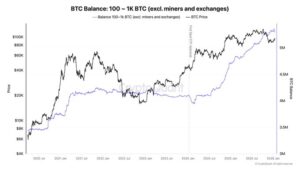

According to Ki Young Ju, U.S.-based institutional wallets, each holding between 100 and 1,000 BTC, have shown particularly significant accumulation. Miners and crypto exchanges are not included in this group, while institutional ETF purchases are included in the calculation.

Ki Young Ju explained:

“Institutional purchases of Bitcoin remain strong. U.S.-based institutional wallets hold between 100 and 1,000 BTC. Miners and exchanges are not included, but ETF purchases are. Since last year, approximately 577,000 BTC, worth about $53 billion, has been added to these wallets. Purchases are still ongoing.”

This indicates that institutional investors do not see short-term price volatility as a significant risk and view Bitcoin as a long-term strategic asset.

Crypto Treasury Companies Also Continue Accumulating

Institutional purchases are not limited to funds and ETFs. Crypto treasury companies are also accumulating Bitcoin, albeit with a more cautious, long-term strategy. Led by Strategy, these companies have acquired around 260,000 BTC since July to strengthen their balance sheets. This demonstrates that Bitcoin is increasingly seen as a strategic reserve asset, not just a speculative investment, for companies.

According to Glassnode, the total Bitcoin held by these crypto treasury companies now exceeds 1.1 million BTC. This shows that a significant portion of Bitcoin supply is locked up by long-term investors. Analysts note that this could limit the amount of BTC available for circulation, helping maintain more controlled selling pressure during volatile periods.

Analysis

CryptoQuant’s data and Ki Young Ju’s statements indicate that institutional demand for Bitcoin remains steady despite overall market fluctuations. In an environment of rising geopolitical risks and ongoing uncertainty in traditional markets, the continued accumulation of Bitcoin by institutional investors serves as an important indicator for medium- and long-term price dynamics.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.