The U.S. Federal Reserve’s interest rate cut triggered an unexpected shock across financial markets. Following Jerome Powell’s cautious remarks, Bitcoin faced a sharp sell-off, plunging to $108,000. This decline led to the liquidation of over $829 million in leveraged positions across major exchanges, affecting more than 165,000 traders who saw their positions wiped out.

Fed’s Cautious Tone Shakes the Market

Investors initially expected the 25 basis point rate cut to boost the crypto market. However, Fed Chair Jerome Powell’s statement “Another rate cut in December is not guaranteed” quickly erased that optimism. His cautious tone prompted a flight from risk assets, triggering a cascade of forced liquidations throughout the crypto market.

Bitcoin dropped rapidly from $110,000 to $108,000, before recovering slightly to trade around $110,500. Meanwhile, Ethereum, Solana, and other major cryptocurrencies also suffered losses between 3% and 6%, reflecting a broad market correction fueled by tightening sentiment and leveraged position wipeouts.

Millions in Liquidations: 165,000 Traders Affected

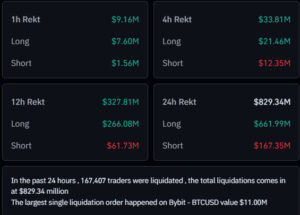

According to data from CoinGlass, over the past 24 hours, a total of $829 million worth of leveraged positions were liquidated. The largest single liquidation occurred on the Bybit exchange, where an $11 million Bitcoin long position was wiped out.

Major trading platforms such as Binance, Bybit, and Hyperliquid also reported the closure of hundreds of millions of dollars in open positions. This event once again highlights how highly leveraged the crypto market has become. The automatic liquidation of overleveraged long positions added intense selling pressure, further accelerating Bitcoin’s downward movement and amplifying the volatility across the broader market.

Short-Term Risks, Long-Term Optimism for Bitcoin’s Price

According to analysts, Bitcoin’s recent price movement appears to be a short-term correction rather than the start of a deeper decline. Holding above the $110,000 support level suggests that the cryptocurrency still maintains technical recovery potential. Analyst Martinez noted that if market confidence returns, BTC could climb back toward the $112,500 – $115,000 range. However, if selling pressure persists, there is a risk of retesting $108,000 or even $106,000, key support zones that could define the next trend.

Macro Factors: Data Uncertainty and Liquidity Outlook

Recent signs of partial improvement in U.S.–China trade relations have slightly eased global market tension. Still, the lack of fresh economic data and uncertainty around liquidity policies until the Fed’s December meeting continue to influence investor sentiment.

Experts say that if the Fed completes its balance sheet reduction program and begins injecting liquidity by the end of the year, it could spark a strong recovery in Bitcoin and other risk assets.

Short-Term Pain, Long-Term Potential

Despite the current correction, analysts believe this selling wave will not derail the broader bullish cycle. Expectations of increased liquidity and balance sheet expansion could create a more favorable environment for crypto markets in the final quarter of the year.

For now, Bitcoin’s $110,000 level remains a critical short-term support. As long as this level holds, targets above $115,000 remain technically within reach, keeping the long-term outlook positive even amid near-term volatility.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.