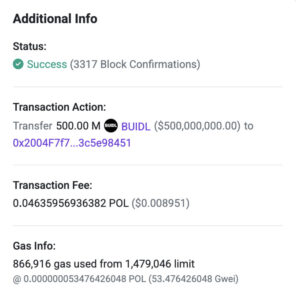

One of the world’s largest asset management firms, BlackRock, has taken a major step forward in blockchain-based finance. The company’s tokenized fund, BUIDL, executed a single transfer worth approximately $500 million on the Polygon (MATIC) network signaling the beginning of a new era in BlackRock’s tokenized asset strategy.

Massive Transfer from BlackRock’s BUIDL Fund to the Polygon Network

BlackRock’s BUIDL, a tokenized treasury fund designed for institutional investors, drew attention with its half-billion-dollar transaction carried out on the Polygon blockchain. This move underscores the firm’s commitment to deepening the integration between traditional finance (TradFi) and decentralized finance (DeFi).

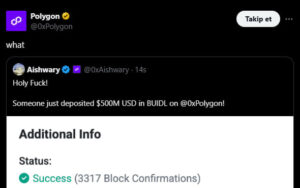

Polygon’s CEO confirmed via social media that this transaction marks the first large-scale allocation of the BlackRock BUIDL fund onto the Polygon network. He emphasized that this milestone not only strengthens Polygon’s institutional infrastructure capabilities, but also highlights BlackRock’s long-term vision for blockchain-based asset management.

The Bridge Between Tokenized Funds and DeFi

The BUIDL (BlackRock USD Institutional Digital Liquidity Fund) offers investors access to tokenized versions of secure assets such as U.S. Treasury bonds. This system enables investors to hold their assets directly on the blockchain and conduct transactions with full transparency.

According to experts, this move marks a turning point in the practical use of tokenized assets within the financial world. Fund managers and institutional investors are now beginning to view on-chain financial instruments not merely as experimental technology, but as tangible investment tools.

Growing Confidence in the Polygon Ecosystem

The $500 million fund transfer has significantly boosted institutional confidence in the Polygon ecosystem. Analysts note that transactions of this magnitude are critical for testing Polygon’s enterprise-grade infrastructure capabilities.

Moreover, this initiative is expected to pave the way for similar fund movements across other blockchains in the near future. Financial analysts suggest that BlackRock’s strategy could set the stage for future integrations with networks like Ethereum, Avalanche, and Solana.

On social media, Polygon’s official account responded to the news by celebrating the milestone, highlighting it as a defining moment for institutional adoption of blockchain technology.

BlackRock Is Shaping the Future of Finance

BlackRock’s massive investment through its BUIDL fund on the Polygon network is seen as more than just a blockchain transaction — it’s a powerful statement about the transformation of the global financial system. This move marks the beginning of a new era where traditional asset management converges with blockchain technology.

Experts emphasize that BlackRock’s strategic vision will not only expand its own portfolio, but also fundamentally reshape how institutional investors approach blockchain technology. This step underscores BlackRock’s role as a trailblazer in bridging traditional finance (TradFi) and decentralized finance (DeFi), setting the foundation for a digitally integrated, transparent, and efficient financial ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.