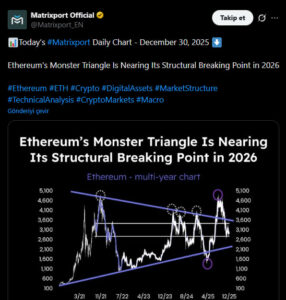

Crypto firm Matrixport has shared its latest technical analysis on Ethereum (ETH) price movements. According to the analysis, ETH is approaching a significant breakout point, and investors should closely monitor the situation to be prepared for potential opportunities and risks. Analysts note that after a prolonged period of price consolidation, the market is entering a phase of directional determination, and they advise investors to act cautiously when making strategic decisions.

Ethereum at a Critical Threshold in a Triangle Formation

Matrixport’s assessment indicates that Ethereum has been moving within a large-scale “triangle formation” for several years. This structure has now narrowed significantly, reaching a critical threshold for directional movement. Experts predict that this prolonged consolidation could result in a clear breakout in 2026.

In the past, Ethereum experienced substantial gains during 2020-2021 as the smart contract platform ecosystem rapidly expanded and the “programmable money” narrative strengthened. New capital entering the market drove ETH prices upward, and during the peak of market sentiment in 2021, levels around $10,000 were even discussed. However, these expectations did not materialize into a lasting trend reversal.

Long-Term Consolidation and Indecision

Following pullbacks from high levels, Ethereum entered a long-term sideways trend with volatile price movements. According to Matrixport, the large triangle formation that emerged during this period indicates prevailing market indecision.

In the past, prices attempted to break out of this formation both upwards and downwards, but in both cases, the moves could not sustain and quickly returned within the range. Currently, the triangle is clearly tightening, and the trading range is narrowing. This technical picture suggests the market is approaching a decision point.

A Critical Period for 2026

Matrixport emphasizes that after this prolonged consolidation, 2026 could be a critical period for Ethereum, where its direction becomes clear and a new trend begins. Analysts warn that volatility may increase during this period, and price fluctuations could intensify in the short term. Investors are advised to act strategically and cautiously to manage risks, as the direction of the triangle breakout could serve as a significant signal for Ethereum’s medium- and long-term price trends.