As expectations around the crypto market’s medium-term outlook begin to take shape, 2026 is emerging as a pivotal year for Bitcoin. While some industry leaders believe easing monetary conditions could act as a powerful tailwind for BTC prices, others caution that macroeconomic and political risks may limit upside potential. At the center of the debate are US Federal Reserve (Fed) policy decisions and the impact of the upcoming US midterm elections.

Monetary Easing and Liquidity Expansion

According to Bill Barhydt, CEO of Abra, global markets could see substantial liquidity injections in 2026. He argues that continued interest rate cuts by the Federal Reserve, combined with the possibility of renewed asset purchases, may push investors back toward risk-on assets such as Bitcoin.

Barhydt points out that the Fed has already begun modest bond-buying activity, signaling a softer monetary stance. He expects demand for US government debt to weaken next year, particularly in a lower-rate environment. If this scenario plays out, expanding liquidity and accommodative policy could provide broad-based support across asset classes, including digital assets.

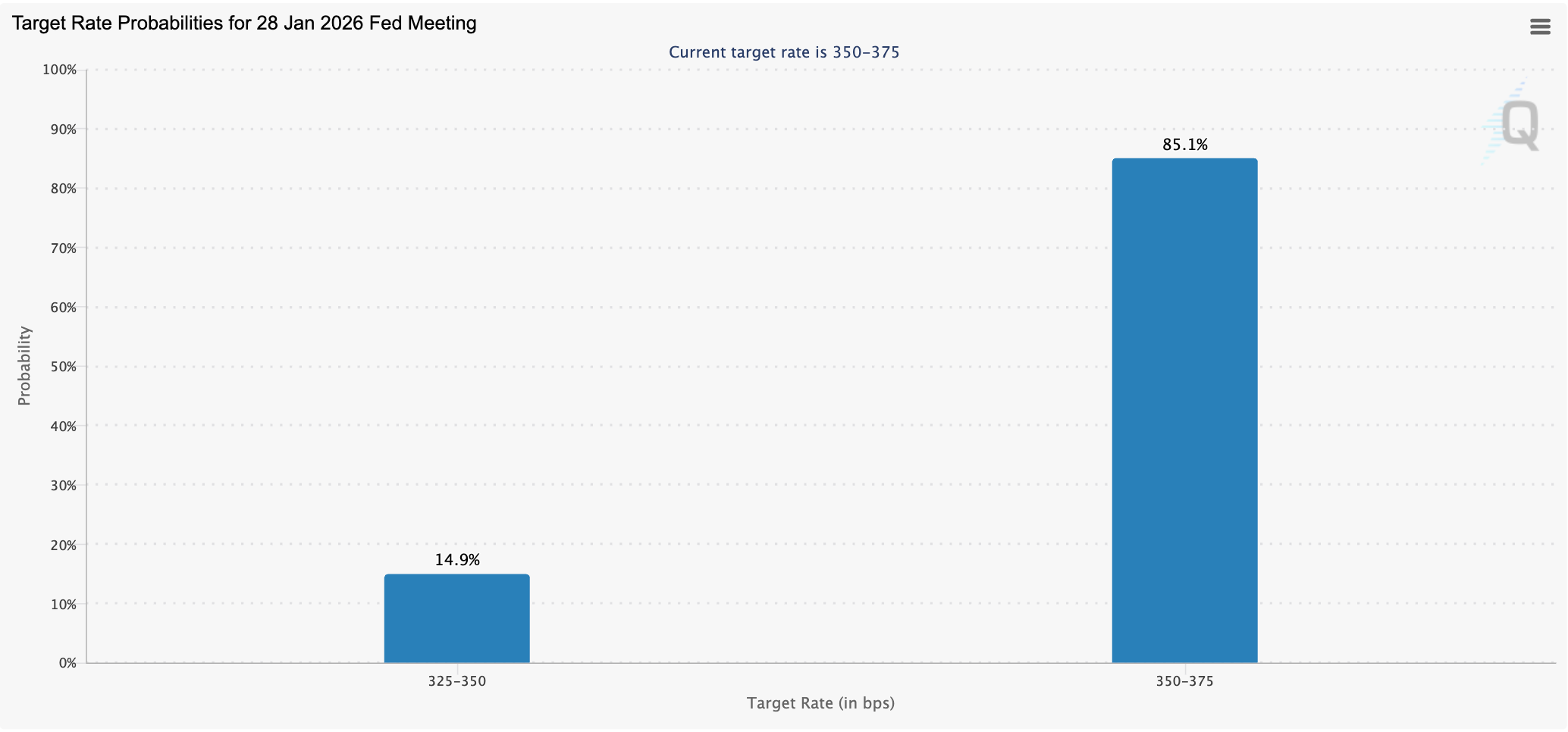

Despite these longer-term expectations, short-term market sentiment remains cautious. Current projections suggest there is roughly an 85% probability that interest rates remain unchanged at the next Federal Open Market Committee meeting, with fewer than 15% of investors expecting a near-term cut.

Institutional Adoption and Regulatory Momentum

Beyond monetary policy, Barhydt highlights regulatory clarity and institutional participation as critical drivers for Bitcoin’s longer-term prospects. In the US, clearer rules around digital assets and growing engagement from institutional investors could help establish a more stable and sustainable growth environment for the crypto market.

Taken together, these dynamics suggest that Bitcoin and the broader crypto ecosystem could experience several constructive years, provided macro conditions remain supportive.

A More Cautious Outlook for 2026

Not all market participants share this optimism. Early Bitcoin investor Michael Terpin believes 2026 could be a challenging year for BTC, potentially marking a deeper phase of the market cycle. He suggests that Bitcoin may bottom near $60,000 in the final quarter of 2026.

Terpin also warns that political developments could offset the benefits of easier monetary policy. In his view, unfavorable outcomes in the US midterm elections could slow or reverse regulatory progress for the crypto sector.

Political Uncertainty as a Market Risk

Prediction markets currently indicate a low probability that a single party will control both chambers of Congress after the 2026 midterms. Historically, shifts in political power during US midterm elections have introduced uncertainty into financial markets.

Ultimately, Bitcoin’s trajectory in 2026 will likely be shaped by a complex interplay of liquidity conditions, regulatory developments, and political outcomes. While the potential for strong upside exists, investors should also be mindful of the structural risks that could influence market direction.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.