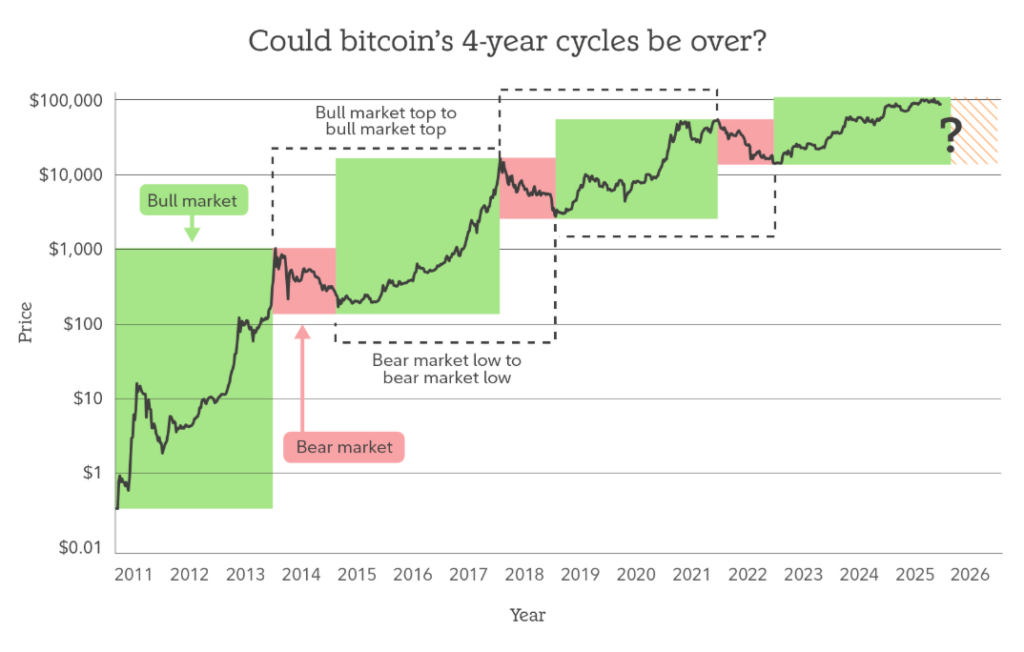

In 2025, Bitcoin typical four-year cycle became a hot topic. Institutional ETFs, U.S. regulatory changes, and global macro risks are challenging the expected post-halving bull run and correction model. This article explores analysts’ views on whether the cycle is broken or still valid, possible price forecasts, national crypto reserve strategies, and growing corporate demand.

What Is the 4-Year Cycle?

Bitcoin four-year cycle is triggered by halving events, which reduce miner rewards by half and slow new supply. Historically, the cycle has three phases:

-

Accumulation Phase: Investors collect Bitcoin as supply tightens. Long-term holders take positions, while new investors enter the market.

-

Bull Run: Approximately 12–18 months after accumulation, prices surge and often reach new all-time highs (ATH).

-

Correction / Bear Market: After the bull run, prices pull back sharply, followed by a multi-year consolidation as the market resets for the next cycle.

“Cycles used to give us a roadmap, but the market is now shaped by more complex dynamics,” says Nick Ruck, director at LVRG Research.

By 2025, institutional ETFs, corporate Bitcoin reserves, and macro factors are reshaping the classic cycle, making price movements more complex than halving alone.

Is the Cycle Broken?

Some analysts argue the four-year cycle broke in 2025. Sustained institutional demand and corporate reserves have softened the typical post-halving drop.

Grayscale predicts strong macro demand and a supportive U.S. regulatory environment will help Bitcoin reach a new ATH in the first half of 2026.

“The four-year cycle theory is no longer valid,” says Geoffrey Kendrick, head of digital assets research at Standard Chartered, revising Bitcoin’s 2026 target to $150,000.

Is the Cycle Still Valid?

Other experts believe the cycle continues. Markus Thielen, CEO of 10x Research, notes:

“Bitcoin entered a bear market in October 2025, pricing in a slowing economy.”

Rekt Capital says even if the cycle is “broken,” it may be just leveling up. Stock-to-Flow creator PlanB points out that selling pressure largely comes from 2021 veterans and traders expecting a post-halving bear market.

“Altcoins showed no excitement; cycles sometimes stretch. They haven’t ended—only expectations have shifted,” says Alex Wacy.

Global Crypto Reserves and Corporate Demand

By 2025, some countries officially created crypto reserves. Kyrgyzstan was among the first, and the U.S. supported the trend via a March 2025 executive order. Brazil’s Congress also advanced a bill allowing up to 5% of international reserves in Bitcoin.

“If more countries add Bitcoin to foreign exchange reserves, others may follow due to competitive pressure,” says Chris Kuiper, research VP at Fidelity Digital Assets.

Corporate demand is also rising. Strategy (formerly MicroStrategy) and over 100 public companies now hold crypto, with 50 of them controlling around 1 million BTC.

“Some corporations can use market access to purchase Bitcoin—arbitrage opportunities supported by investment mandates and regulations,” Kuiper adds.

However, risks remain. Bear markets or forced corporate sales could put downward pressure on Bitcoin or other digital assets.

Why It Matters

Bitcoin’s four-year cycle, government reserves, and corporate adoption will shape market dynamics in 2026. Investors should monitor these factors when assessing price trends and risk.

2025 highlighted questions around Bitcoin’s traditional cycles and showed accelerating demand from nations and corporations. 2026 will test these new norms and risks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.