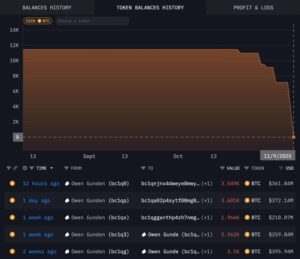

The cryptocurrency market was shaken today. A Satoshi–era whale that had remained inactive for 13 years broke its silence by transferring 12,000 BTC worth approximately $1.4 billion. The sudden movement of such a large amount of Bitcoin naturally increased uncertainty in the markets and forced a short-term pullback in the Bitcoin price.

Awakening After 13 Years: 12,000 BTC Moved

According to on-chain data, the whale’s wallet had not made a single transaction since the years when Bitcoin was trading at just a few hundred dollars. This massive amount moved today is being interpreted by analysts as one of the most profitable Bitcoin sales ever recorded.

This move has brought two different viewpoints to the forefront in the market:

- Some investors voice concern that “early BTC holders have started to exit the market.”

- Others believe the whale may simply be realizing profits as part of a natural long-term accumulation strategy.

Both perspectives are affecting investor sentiment and increasing volatility.

Panic Spread Quickly: Bitcoin Drops 2%

The possibility that the transfer was sent to exchanges triggered fears among investors of a “large near-term sell-off.” Since whale movements are known to have the potential to influence the direction of the market, this development was reflected in Bitcoin’s price within minutes.

In a short time:

- Bitcoin lost 2% in value,

- Traders were forced to close their leveraged positions,

- Selling pressure increased in the spot market.

Analysts emphasize that such large transfers can often trigger a chain of liquidations and that this represents a critical threshold for the market.

Bitcoin at a Technically Critical Zone

According to leading crypto analyst Ted, BTC is currently at a technical breaking point:

- The $104,000–$105,000 range is a fierce battleground between bulls and bears.

If Bitcoin strongly breaks above this level and holds, a rapid move toward $107,000 and $109,000 could follow.

However, if the resistance zone is not broken, the market’s “tired” appearance suggests that Bitcoin risks pulling back to the major support at $100,000.

For this reason, whether the whale has actually sold its holdings, whether the selling continues, and whether new large transfers appear are all being closely monitored.

Market in Alarm Mode

Every major wallet from the Satoshi era that suddenly becomes active has long been seen as a precursor of significant price movements in the crypto market. Today’s 12,000 BTC transfer is no exception. Market uncertainty is high, risk appetite is weak, and investors’ eyes are firmly on on-chain data. How Bitcoin reacts to this critical resistance zone in the coming hours will play a decisive role in determining the direction of the market.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.