The debate over what Bitcoin truly represents has resurfaced once again. Is it a form of money, a digital commodity, or something entirely different? While this discussion has existed since Bitcoin’s creation, it has gained renewed attention due to the contrasting views of prominent figures within the crypto ecosystem. At the center of the debate stands Michael Saylor, executive chairman of Strategy, whose interpretation of Bitcoin differs notably from traditional monetary narratives.

How Michael Saylor Defines Bitcoin

Bitcoin was originally introduced as a peer-to-peer electronic cash system, designed to function as an alternative to traditional money. However, Saylor does not frame Bitcoin primarily as a medium of exchange. Instead, he views it as a hard asset with properties similar to commodities such as crude oil.

According to this perspective, Bitcoin itself is the raw material. Strategy’s role, in Saylor’s view, is to transform this raw digital asset into structured financial instruments that allow broader investor access. Rather than promoting Bitcoin as a payment tool, the focus is on positioning it as a foundational asset for financial engineering.

Strategy’s Bitcoin-Centered Financial Architecture

This asset-driven philosophy is reflected in Strategy’s corporate actions. The company has built a financial model that enables investors to gain indirect exposure to BTC using traditional capital market instruments. Publicly traded equity offers leveraged exposure to Bitcoin’s price movements, while convertible debt and perpetual preferred shares provide additional mechanisms for capital raising.

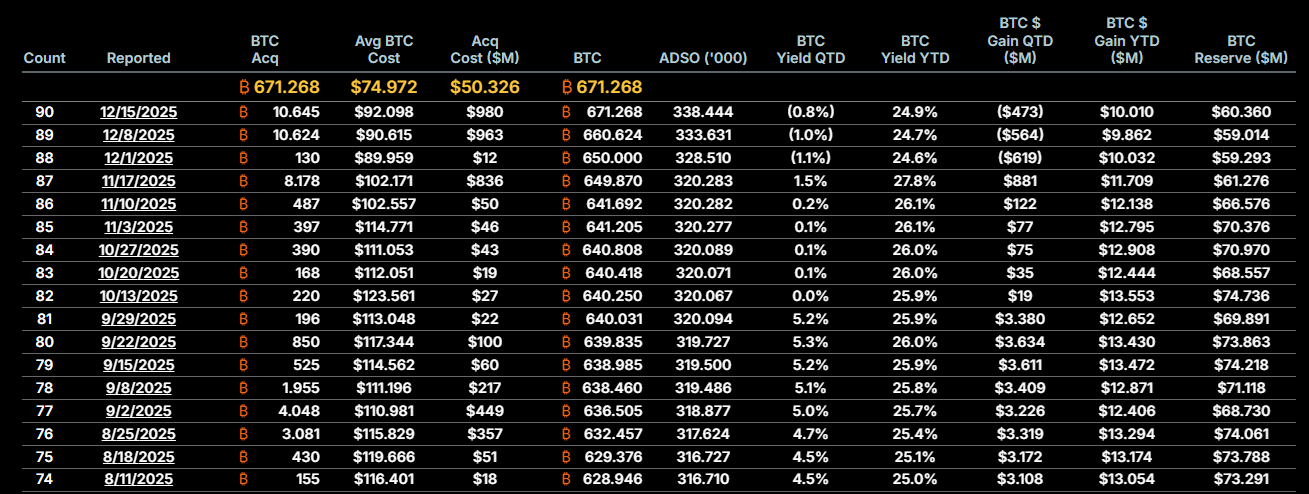

These funds are consistently funneled back into Bitcoin accumulation. As of mid-December, Strategy’s holdings exceeded 671,000 BTC, highlighting how central Bitcoin has become to the company’s long-term strategy.

The Counterargument: Bitcoin as Money

Not everyone agrees with framing BTC primarily as a commodity-like asset. Economist Saifedean Ammous argues that such strategies do not undermine BTC’s monetary nature. From his perspective, Bitcoin itself is the money, and financial products built around it are secondary.

Ammous emphasizes that global fiat money supplies continue to expand annually, largely driven by debt-based systems. In this environment, BTC increasingly functions as pristine collateral. Over time, individuals and institutions may need to hold Bitcoin directly to access more favorable financial conditions, reinforcing its role as money rather than diminishing it.

Two Perspectives, One Outcome

Although Saylor’s asset-focused framework and Ammous’ monetary thesis appear fundamentally different, they converge on a key point: sustained demand for BTC. Whether viewed as a strategic commodity or as the future of money, both interpretations suggest BTC will play an expanding role in global finance. The real question may no longer be what BTC is, but how it will ultimately be used.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.