Bitcoin demand growth has significantly slowed since October 2025, and analysts suggest that a new bear market may be underway. According to CryptoQuant data, most of the incremental demand in this cycle has already been realized, removing a key pillar of price support.

Demand Waves And Market Movements

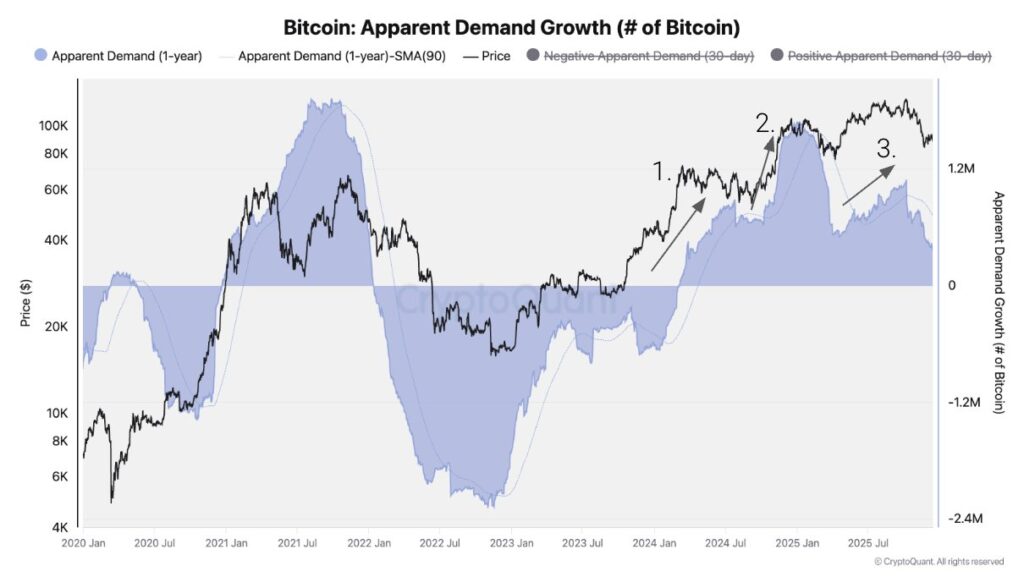

CryptoQuant analysts highlight three major demand waves in this cycle. The first wave followed the US Bitcoin ETF launch in January 2024, the second came after the 2024 US presidential election, and the third was driven by the Bitcoin Treasury Companies bubble. Analysts note:

“The Bitcoin demand boom is fading. This cycle ran on three major spot demand waves, and the latest one appears to be rolling over. Since early October, demand has been below trend, which can remain bearish for price.”

Institutional Demand Declines

Institutional investor interest is also contracting. In Q4 2025, Bitcoin ETFs saw holdings drop by approximately 24,000 BTC, sharply contrasting the strong accumulation in Q4 2024. Funding rates for perpetual futures have fallen to their lowest levels since December 2023, further reinforcing bearish signals.

Bitcoin’s price structure has broken below the 365-day moving average, a key dynamic support level. Analysts warn that this breach strengthens the likelihood of a bear market.

Potential Downside Levels

Analysts note that historically, Bitcoin bear market bottoms align with realized price levels. Current estimates place this level around $56,000. This implies a potential drawdown of about 55% from the recent all-time high, one of the smallest declines on record. Intermediate support is expected around $70,000. Analysts emphasize that these levels serve as guidance, and the market can always produce surprises.

Future Outlook And Market Sentiment

Some analysts remain optimistic for 2026, but overall market sentiment remains in “fear” territory. Falling interest rates, potential increases in demand, and risk asset catalysts may provide support. The Crypto Fear and Greed Index from CoinMarketCap shows investor sentiment firmly in the fear zone.

US monetary policy remains uncertain. CME Group’s FedWatch tool shows only 22.1% of investors expect the FOMC to cut rates in its January meeting. Political developments are also influential; US President Donald Trump reportedly pressured Fed Chair Jerome Powell to lower rates in 2025, and with Powell’s term ending in May 2026, potential replacements are expected to favor rate cuts.

Why It Matters?

Falling demand, institutional outflows, and broken technical support could shape Bitcoin’s trajectory in the coming months, directly influencing investor strategies and market risk appetite.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.