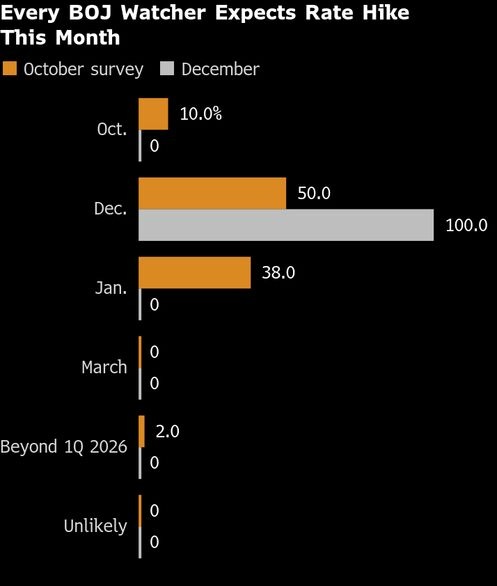

Japan’s financial markets have entered a period of heightened anticipation as government bond yields climb to levels not seen in many years. Growing consensus within Tokyo’s policy circles suggests that the Bank of Japan (BoJ) is preparing for a decisive move at its upcoming December meeting. According to reports from leading Japanese outlets, a majority of board members are leaning toward a 25-basis-point interest rate increase — a step that would mark one of the most significant tightening actions in nearly three decades.

A December Decision: Markets Brace for a 25 bps Increase

The policy meeting scheduled for December 18–19 is expected to confirm the BoJ’s commitment to continuing its normalization process. Current market pricing reflects an anticipated adjustment of the benchmark rate from 0.50 percent to 0.75 percent. Governor Kazuo Ueda’s recent public statements have consistently pointed toward the need for further tightening, reinforcing expectations that the central bank intends to follow through.

A Data-Driven Path: BoJ Mirrors the Fed’s Approach

Insights shared with Reuters indicate that Japan’s central bank will adopt a strategy similar to that of the U.S. Federal Reserve, basing future decisions on the trajectory of economic data. The pace of subsequent rate increases will depend heavily on how domestic activity responds to tighter financial conditions. Sources familiar with internal discussions suggest policymakers still view Japan’s rates as exceptionally low, leaving the institution with considerable room to act.

A Level Unseen Since 1995

If implemented, the expected hike would move Japan’s policy rate to 0.75 percent — a level last recorded in 1995. Despite decades of ultra-accommodative policy, the country now faces an inflation rate of around 3 percent, notably above the BoJ’s 2 percent target. For years, low borrowing costs enabled Japanese investors to access credit with ease and deploy capital globally, contributing to more than 12 trillion dollars in overseas assets.

A shift toward higher domestic yields raises the prospect of capital flowing back into Japan, a scenario that global financial markets are monitoring with caution.

Market Repercussions: Japan Policy Moves and Bitcoin’s Sharp Drop

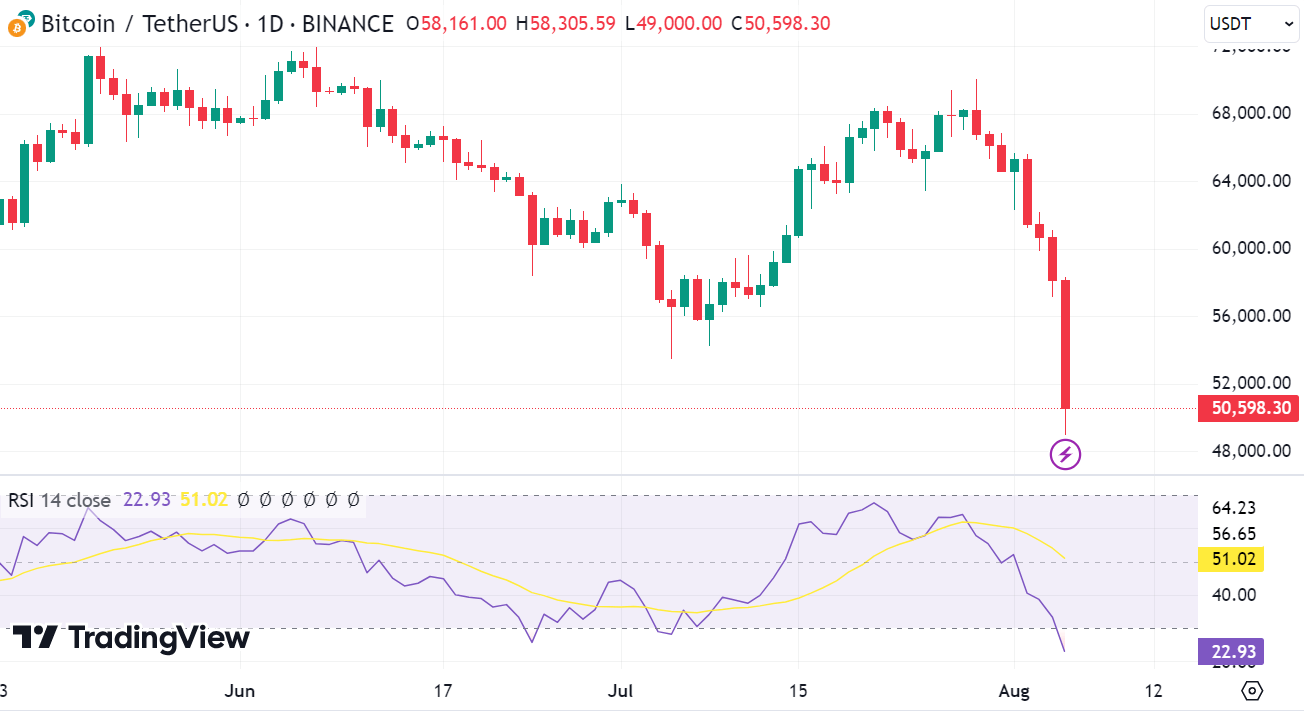

Japan’s previous rate adjustments have already demonstrated their influence on global markets. The hike implemented at the end of July 2024 coincided with an unexpected financial shock in the United States, leading Bitcoin to fall to 49,000 dollars on August 5. Although the cryptocurrency market later recovered — aided by Donald Trump’s U.S. election victory — the episode underscored the sensitivity of global risk assets to changes in Japanese monetary policy.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.