Binance Coin (BNB) is showing a notable upward trend in the cryptocurrency market as September 2025 comes to a close. The 10% price increase over the weekend has brought BNB back onto investors’ radar.

On September 19, 2025, BNB reached a new peak at $1,048. However, this rapid rise pushed the RSI indicator into the overbought zone, raising the possibility of a short-term correction. Analysts indicate that the price could pull back to around $1,012, which also aligns with the 0.236 Fibonacci retracement. If selling pressure increases, the 50-4H EMA at $974 stands out as a strong support level.

You may also find this interesting: DEAPcoin (DEP) Explained: PlayMining & Web3 Game Token

Analysts’ Year-End Expectations for BNB

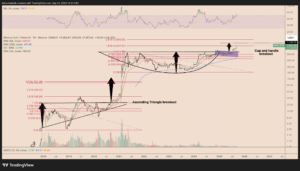

Long-term technical indicators suggest that BNB could reach a price range between $1,250 and $1,565 by the end of the year. This forecast is particularly supported by the completion of the cup-and-handle formation and Fibonacci extensions. For instance, the 1.618 Fibonacci extension at $1,037 serves as a strong support level.

Analysts’ BNB price predictions for the end of 2025 are as follows:

- CoinCodex: $1,054.40

- Kraken: $1,069.18

- Changelly: $676.31

- CoinCodex: potential increase up to $1,427.06

These predictions are based on technical analysis and market sentiment.

BNB’s Net Unrealized Profit/Loss (NUPL) metric has risen above $600, indicating investor optimism. This is generally considered a sign of mid-cycle strength. Additionally, increasing trading volumes in BNB’s derivatives market and long-term overweight positions suggest that the bullish trend may continue.

How Is BNB’s Future Shaping Up?

Institutional investments and strategic partnerships play a key role in BNB’s value growth. For example, Nano Labs’ plan to purchase $1 billion worth of BNB is seen as a sign of adoption by institutional investors. Furthermore, Binance’s partnership with Franklin Templeton to develop digital asset products enhances confidence in Binance Coin. In light of technical indicators, on-chain data, and institutional investments, BNB could show strong performance through the end of 2025. However, investors should consider short-term corrections when planning their strategies. In the long term, the $1,250 – $1,565 range remains an achievable target for BNB.

Current Market Data

For the latest cryptocurrency news, click here