Federal Reserve (FED) officials describe the U.S. economy as “stable but fragile.” Officials emphasized that the current monetary policy path will remain cautious. The goal here is to proceed meticulously, step by step, toward the target.

What Is the Current Economic Outlook for the United States?

The current inflation rate in the United States is hovering around 3%. However, the FED’s target is to bring this figure down to approximately 2% annually. The interest rate applied to the U.S. dollar currently stands at around 4%. Considering the “stable but fragile” market conditions mentioned by the FED, it is expected that this rate may decline toward 3% in the near future.

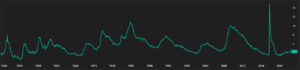

The U.S. unemployment rate, which reached a historic peak of 14.9% in 2020, has since corrected to 4.3%. However, when examining the labor market over the past few months, little change is observed. Although progress continues, some FED officials consistently highlight that employment growth has slowed significantly — a trend that could lead to a higher unemployment rate.

Although the flames around tariffs seem to have cooled in recent months, tariff policies and global trade uncertainties will likely have a negative impact on inflation. This uncertainty appears poised to influence inflation in a positive direction.

You may also be interested in this article: Bitcoin’s Buy and Sell Ratio Turns Positive for the First Time: A Strong Bullish Signal

How Are the FED and Its Officials Interpreting the Situation?

- Philip Nathan Jefferson (FED Vice Chair):

I supported the FOMC rate cut in October. Overall, the economy hasn’t changed much in recent months, but the lack of progress on inflation appears to stem from tariffs. Interest rates are close to neutral, so it’s better to move slowly. - Michael Solomon Barr (FED Board Member):

Progress has been made on inflation, but there’s still work to be done. - Christopher J. Waller (FED Board Member):

Stablecoins are not a threat to monetary policy. - Beth M. Hammack (FED Bank President):

I do not believe current economic data justify a rate hike. The people I’ve spoken with indicate that the labor market remains in an environment of low hiring and low layoffs. Keeping the Fed’s policy restrictive will help bring inflation down.

How Do Trump’s Trade Policies Affect the Economy?

Donald Trump referred to the ongoing legal process regarding tariffs and mentioned the need for new alternative plans. He stated that if the Supreme Court case ends unfavorably, an alternative plan is ready — though it would progress more slowly. FED officials may interpret the resulting price increases from these tariffs as renewed inflationary pressure. This is because, inevitably, import costs — and thus consumer prices — are likely to rise.

For the latest crypto news, click here to join our Telegram channel.