The spot crypto ETF data dated 24 November reveals a clear shift in overall investor behavior compared to previous periods. While Bitcoin funds experienced significant outflows, altcoin-focused ETFs such as Ethereum, Solana, and XRP recorded notable net inflows. This trend suggests that, amid market uncertainty, investors are partially moving away from Bitcoin and turning toward altcoin ETFs that they believe offer higher return potential.

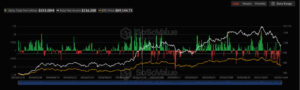

Major Outflows from Bitcoin Spot ETFs

One of the most striking highlights of the day was the $151.08 million net outflow from Bitcoin ETFs. Despite market-wide selling pressure, Fidelity’s FBTC stood out as the only Bitcoin fund that ended the day with a net inflow.

Analysts note that the outflows on the BTC side indicate investors de-risking by shifting toward less volatile assets or simply reducing exposure due to market uncertainty. Bitcoin’s recent price volatility is also seen as a key factor driving fund outflows.

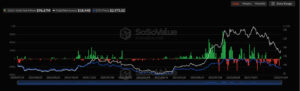

Demand Strengthens in Ethereum ETFs

Ethereum ETFs showed the opposite trend. With a total $96.67 million net inflow, investor demand for ETH has strengthened significantly. BlackRock’s ETHA led decisively with $92.61 million in inflows, underscoring the concentration of institutional interest in this particular product. According to analysts, Ethereum’s expanding ecosystem continues to support medium-term bullish expectations within the ETF market.

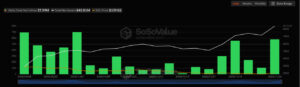

Strong Inflows into Solana Spot ETFs

Solana ETFs closed the day in positive territory, posting $57.99 million in net inflows. Solana’s recent performance, growing application ecosystem, and increasing on-chain activity are major factors driving demand for these funds. Experts highlight that Solana has become an increasingly attractive alternative for institutional investors seeking exposure outside of Ethereum.

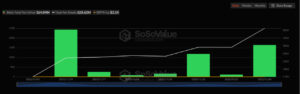

Record-Level Inflows into XRP Funds

The most remarkable figure of the day came from XRP ETFs, which recorded an impressive $164.04 million net inflow—the highest among all major altcoin spot ETFs on 24 November. This unexpectedly strong demand signals renewed institutional positioning in XRP. The easing of regulatory uncertainty following XRP’s legal developments has further strengthened long-term investor sentiment.

Overall Assessment

The 24 November data indicates that capital is moving dynamically within the crypto ETF market and that investor behavior is undergoing notable changes. Despite outflows in Bitcoin funds, the strong demand for altcoin ETFs has brought a positive tone to the broader market. Whether this momentum in Ethereum, Solana, and XRP funds will continue remains one of the key factors shaping the overall direction of the crypto market in the coming period.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.