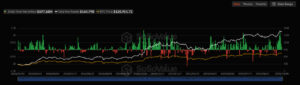

As of October 9, spot Bitcoin ETFs recorded a net inflow of $197.68 million, demonstrating continued strong investor interest. This marks the ninth consecutive day of positive inflows into Bitcoin ETFs. The sustained momentum indicates that investors are regaining confidence in the crypto market, with institutional demand for Bitcoin notably strengthening.

According to experts, macroeconomic uncertainties and a global risk-off sentiment are directing investors back to Bitcoin, often seen as digital gold. The regulated investment infrastructure provided by spot ETFs offers traditional fund managers a secure gateway to enter the cryptocurrency market.

Eight-Day Positive Streak in Ethereum ETFs Ends

While Bitcoin ETFs continued to see strong inflows, spot Ethereum ETFs recorded a net outflow of $8.54 million during the same period. This ended the eight-day consecutive inflow streak for Ethereum ETFs. Analysts attribute this outflow to short-term profit-taking and market volatility. In particular, ETH’s resistance around the $4,300 level in recent weeks has prompted some investors to sell for gains.

Despite this, long-term expectations for the Ethereum ecosystem remain positive. ETF investors are believed to be waiting for price stability before resuming purchases.

Market Impact of ETF Flows

Continuous inflows into Bitcoin ETFs are reinforcing institutional investors’ optimism in the market, while the outflows from Ethereum ETFs indicate a cautious short-term stance among traders.

Financial analysts note that the strong inflows into Bitcoin ETFs could create upward price pressure, whereas the temporary pause in Ethereum inflows is considered normal market behavior.

Analysis

As of October 9, the crypto ETF landscape shows that Bitcoin continues to be viewed as a safe-haven asset by institutional investors, while Ethereum investors remain sensitive to short-term volatility. The nine consecutive days of net inflows into Bitcoin ETFs signal price stability and strengthened market confidence, whereas the net outflows in Ethereum ETFs are seen as a temporary correction.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.