The crypto market in 2025 witnessed both historic developments and sharp volatility. The Bitcoin and altcoin ecosystem was shaped not only by technological and financial innovations, but also by regulatory actions, major hack incidents, political decisions, and sudden market crashes. Developments throughout the year directly influenced investor behavior, institutional interest, and overall market dynamics. While some events strengthened long-term adoption and the role of crypto assets in the financial system, others led to serious losses of confidence, heightened volatility, and price declines. This complex picture highlights 2025 as a critical year for the crypto ecosystem in terms of both opportunities and risks.

Full Pardon for Ross Ulbricht

Just one day after taking office, U.S. President Donald Trump issued a full and unconditional pardon to Ross Ulbricht, the founder of Silk Road. This move was seen as one of Trump’s campaign promises to the crypto community. The decision reignited discussions around early Bitcoin ideals such as individual freedom, censorship resistance, and financial sovereignty. It generated widespread reactions within the crypto community and was interpreted as a symbolic shift in the U.S. government’s stance toward digital assets.

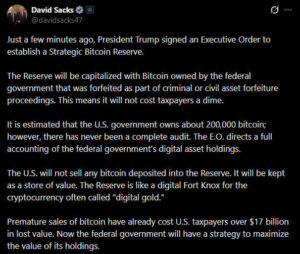

U.S. Strategic Bitcoin Reserve Established

On March 6, the Trump administration signed an executive order announcing the creation of a Strategic Bitcoin Reserve composed of approximately 200,000 BTC seized through legal proceedings. This marked a historic step in positioning Bitcoin as a strategic asset at the state level. Additionally, instructing the Treasury and Commerce Departments to develop Bitcoin acquisition strategies without burdening taxpayers signaled a long-term change in U.S. crypto policy.

GENIUS Act Comes into Effect

In July, the U.S. House of Representatives passed the GENIUS Act, which aims to regulate the stablecoin market. The law clarified transparency requirements, reserve obligations, and audit standards for stablecoin issuers. Progress on the CLARITY bill during the same period also helped create a more predictable legal environment for crypto markets. Market participants noted that these regulations could accelerate institutional capital inflows into crypto.

IRS Rule Burdening DeFi Repealed

In March, the U.S. Senate repealed an IRS rule that would have subjected DeFi front-end providers to the same obligations as traditional brokers. After Trump signed the repeal into law in April, the DeFi ecosystem was relieved of a major regulatory burden. This move was widely viewed as a critical turning point for decentralized finance projects operating in the U.S.

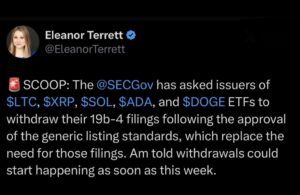

SEC Loosens Crypto ETF Standards

The U.S. Securities and Exchange Commission (SEC) relaxed listing standards for crypto ETFs, paving the way for spot Solana (SOL) and XRP ETFs. The new framework shortened the 19b-4 review process, significantly reducing approval timelines. This development made it easier for institutional investors to access the altcoin market and supported ETF-driven demand.

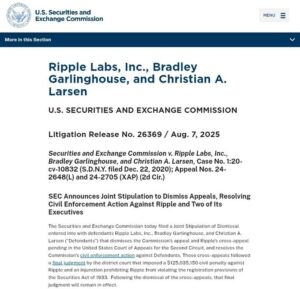

SEC–Ripple Lawsuit Officially Ends

In August, the SEC and Ripple mutually withdrew their appeals, officially ending a years-long legal battle. This marked the end of regulatory uncertainty for XRP and was seen as a precedent-setting outcome for other crypto projects. The market interpreted the resolution as a strong signal of regulatory easing in the U.S.

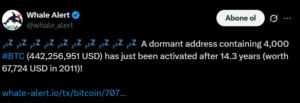

Satoshi-Era Bitcoin Whales Begin Selling

Throughout 2025, the reactivation of long-dormant Bitcoin wallets from the Satoshi era drew significant attention. Large-scale sales from these wallets introduced billions of dollars’ worth of supply into the market. While these sales put short-term pressure on Bitcoin’s price, they also notably increased market volatility.

Whale activity impacted investor psychology, triggering speculative trading behavior and making the market more prone to sudden price swings. This trend became one of the key factors testing Bitcoin’s resilience and intensifying investor focus in 2025.

Bybit Hack: The Largest in Crypto History

In February, crypto exchange Bybit suffered one of the largest cyberattacks in history, resulting in the loss of approximately $1.4 billion worth of Ethereum (ETH). The incident severely shook investor confidence and reignited concerns over exchange security infrastructure. Surpassing previous breaches such as Mt. Gox, Coincheck, and FTX, the hack marked a major milestone in crypto history.

In response, Bybit took extensive measures to compensate losses and strengthen security systems. The event also served as a warning for the entire industry, underscoring the critical importance of asset protection and robust security protocols.

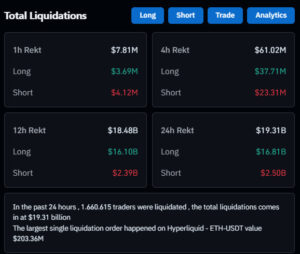

Historic Leverage Crash in October

In October, a massive deleveraging event led to the liquidation of more than $20 billion in positions across the crypto market. Excessive leverage amplified price pressure and caused sharp fluctuations within a short period. The crash once again highlighted the critical importance of risk management for investors and exchanges alike.

Following steep losses in some Earn products, Binance compensated users with a total of $283 million, demonstrating its commitment to user trust and responsibility. The incident served as a strong reminder to the ecosystem about the risks of high leverage and the need for prudent liquidity management.

The DAT Frenzy Comes to an End

In 2025, many companies added Bitcoin and Ethereum to their balance sheets, attempting to follow Strategy-style investment models. This trend boosted institutional interest in crypto assets and created short-term market momentum. However, changing market conditions, heightened volatility, and rising risks caused the trend to lose momentum over the course of the year.

This wave—referred to as DAT—initially attracted strong interest but ultimately faded by year-end. The process clearly demonstrated that institutional adoption of crypto assets comes with both significant opportunities and substantial risks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.