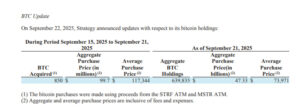

Institutional investors’ interest in the cryptocurrency market is once again gaining momentum. In this context, the latest notable move came from the investment firm Strategy. Between September 15 and September 21, 2025, the company purchased a total of 850 Bitcoins (BTC). These acquisitions were made at an average cost of $117,344, with the total transaction amount reaching approximately $99.7 million.

Institutional Investors’ Bitcoin Strategy

In recent years, crypto assets have been gaining an increasingly important place in institutional portfolios. Bitcoin, in particular, has become a preferred asset in corporate reserve strategies due to its limited supply, high liquidity, and long-term value storage potential.

Strategy’s latest purchase is seen as a strong example of this approach. The company’s accumulation of Bitcoin during a volatile market period highlights its long-term investment vision.

The Importance of the Average Purchase Price

It is noteworthy that Strategy’s acquisitions were made at an average price of $117,344. Throughout the year, Bitcoin has experienced sharp fluctuations, even dropping below $100,000 at times. Despite this, the company’s entry above $117,000 signals a strong expectation that the market could climb to much higher levels in the future.

Such institutional purchases can help establish a price floor for Bitcoin and reinforce market sentiment.

Details of the Total Investment

- Acquisition Period: September 15 – 21, 2025

- Total Acquired: 850 BTC

- Average Price: $117,344

- Transaction Value: $99.7 million

With this new purchase, Strategy’s Bitcoin holdings have further increased, clearly demonstrating the company’s confidence in crypto assets.

Strategy’s Bitcoin purchase can be viewed not only as a short-term investment move but also as part of a long-term reserve strategy. By positioning Bitcoin as a reserve asset—similar to gold—the company aims to achieve portfolio diversification and value preservation. This approach could accelerate the adoption of Bitcoin among other major corporations and funds.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.