The cryptocurrency markets experienced a severe shock during the last trading day of the week. Bitcoin’s sudden and sharp decline triggered mass liquidations across leveraged positions, wiping out nearly $2 billion in the past 24 hours. With Bitcoin briefly dropping to $82,000—its lowest level since April—the total crypto market cap fell to $2.9 trillion.

This collapse cannot be explained solely by spot market selling. Analysts say the move reflects deeper structural stress involving both macroeconomic pressures and crypto-specific liquidity issues.

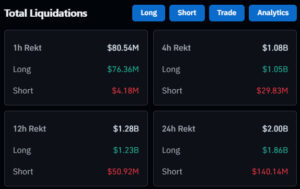

$2 Billion in Liquidations: Liquidity Breaks Down

According to CoinGlass, more than 396,000 traders saw their positions forcibly closed in the last 24 hours. Those using high leverage suffered the most. The largest single liquidation was a $36.78 million BTC-USD position on Hyperliquid DEX showing just how large leverage has become even within decentralized exchanges. Since liquidation data is not fully real-time, analysts believe the actual number may exceed $2 billion.

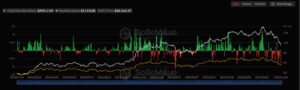

Bitcoin Falls to $82,000: Its Weakest Month Since 2022

Bitcoin has dropped more than 30% from its October highs, briefly touching $82,000. This marks:

- Its worst monthly performance since the 2022 crash

- The weakest Q4 results since 2018

- The first time since May that total crypto market cap has fallen below $3T

The selloff was fueled not only by spot market selling but also by capitulating short-term investors and forced liquidation cascades. Analysts warn that unless BTC reclaims the critical $88,000–$90,000 resistance zone, it may continue drifting within the $78,000–$82,000 liquidity zone, where volatility remains high.

ETF Outflows Deepened the Crash

One of the biggest triggers was the massive withdrawal from Bitcoin ETFs:

- $903 million net outflows in one day

- The second-largest exit since ETF launch

Wall Street’s retreat further drained liquidity and intensified the selloff. ETF outflows not only reduced spot demand but also worsened overall risk sentiment..

Analysts: “This Is Not Rational Selling—It’s Forced Liquidation”

Timothy Misir, Head of Research at BRN, pointed out that the market is now driven by fear:

- The Fear & Greed Index fell to 14 (extreme fear)

- Bitcoin is in a capitulation zone

- Forced liquidations—not natural buying and selling—are dominating price action

The realized loss levels among short-term holders match those seen during:

- The May 2021 crash

- The two major corrections in mid-2024

indicating another cyclical capitulation may be underway.

Macro Pressure: A Complicated Picture

Several macroeconomic developments contributed to selling pressure:

- S. jobs data came in above expectations (119,000 new jobs), reducing recession fears and weakening rate-cut expectations

- The incoming Fed chair signaled opposition to cutting rates soon

- Japan announced a $135B stimulus package, which supported global markets—yet it was insufficient to prevent the crypto liquidation shock

Altcoins Bleed Heavily

Bitcoin’s crash sent altcoins into even deeper losses. Major assets including:

- Ethereum

- Solana (SOL)

- BNB

- Avalanche (AVAX)

- Dogecoin

all posted double-digit declines in 24 hours, showing this was a market-wide deleveraging event—not a Bitcoin-only correction. This crash is the result of: ETF outflows + high leverage + forced liquidations + weak liquidity + macro uncertainty. Short-term volatility is expected to remain high. However, many analysts believe that once forced sellers are exhausted, the market could enter a sharp and rapid recovery phase.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.