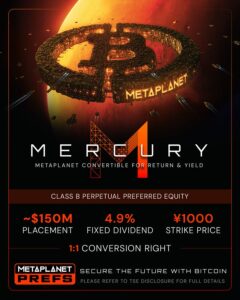

Japan-based investment firm Metaplanet has announced plans to issue $150 million worth of Class B perpetual preferred shares as part of its strategy to further expand its Bitcoin holdings and aggressively grow its asset base. This move stands out as one of the company’s most significant steps in strengthening its long-term Bitcoin investment vision.

New Multi-Million Dollar Financing: Direct Support for Bitcoin Purchases

The newly issued preferred shares will offer a fixed annual dividend of 4.9% and will be used entirely to finance additional Bitcoin acquisitions. Metaplanet’s goal is to position Bitcoin as a larger and more strategic long-term asset on its balance sheet. This financing structure reflects the company’s approach of combining traditional financial tools with the innovation offered by the crypto market.

One of Asia’s Largest Institutional Bitcoin Holders

Already holding more than 30,000 BTC, Metaplanet is considered one of Asia’s largest institutional Bitcoin investors. With this new funding round, the company aims to further expand its Bitcoin reserves and strengthen its long-term treasury strategy.

This approach aligns with the growing trend of companies viewing Bitcoin not just as an investment, but as a store-of-value asset used to reinforce corporate balance sheets.

Japan’s Contribution to Global Bitcoin Adoption

Metaplanet’s latest initiative also highlights the shifting stance of Japan-based institutions toward crypto assets. The company’s increasingly aggressive Bitcoin accumulation strategy reflects rising institutional interest in digital assets across the region.

This move also signals:

- Strengthening confidence among institutional investors in Bitcoin’s long-term value proposition

- Growing interest in Bitcoin as an alternative reserve asset during economic uncertainty

- Continued expansion of institutional ownership within the crypto market

Conclusion

Metaplanet’s issuance of $150 million in perpetual preferred shares underscores just how committed and forward-looking its Bitcoin strategy is. Combining a dividend-bearing traditional financing instrument with an aggressive Bitcoin accumulation plan could elevate Metaplanet’s position among Asia’s top institutional Bitcoin holders. This step also serves as a powerful example of how Bitcoin continues to gain traction as a long-term store of value on corporate balance sheets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.