As selling pressure and volatility continue to weigh on the crypto market, institutional investors’ strategic moves remain in the spotlight. Despite declining prices and ongoing uncertainty, major players continue to strengthen their long-term positions. Two notable developments this week are BitMine’s acceleration of its aggressive ETH accumulation strategy and company president Tom Lee’s updated Bitcoin price forecast. Both events highlight institutional confidence in crypto and expectations for the future.

BitMine Aggressively Increases Its Ether Holdings

According to Lookonchain data, BitMine Immersion Technologies purchased a total of 23,773 ETH over the past three days despite the market downturn. The purchases consisted of:

- 7,080 ETH on Monday for approximately $19.8 million

- 16,693 ETH on Saturday for approximately $50.1 million

Together, these acquisitions total roughly $70 million.

These purchases follow last week’s large transaction, in which BitMine acquired 96,798 ETH for $272.3 million. With the latest additions, BitMine’s total ETH holdings have risen to 3,726,499 ETH, worth approximately $10.48 billion.

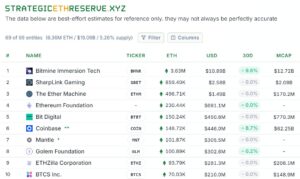

According to strategicethreserve.xyz, BitMine is currently the largest ETH digital asset treasury (DAT) in the market. The company’s long-term goal is to hold 5% of Ether’s total supply. Currently, 62% of that target has been achieved. However, with an average acquisition cost of $3,008 per ETH, a significant portion of BitMine’s holdings is currently underwater.

Tom Lee Revises His Bitcoin Forecast

BitMine president Tom Lee has significantly revised his long-awaited Bitcoin price forecast. Earlier this year, Lee predicted that Bitcoin would reach a new all-time high of $250,000 by the end of 2025. However, due to weak market conditions heading into 2025, he rolled back his projection last week.

In a statement to CNBC, Lee said:

“I think Bitcoin could hit an all-time high by the end of January. A lot of that will depend on the recovery in equities.”

No Concrete Reason Behind the Crypto Sell-Off

Jeff Dorman, Chief Investment Officer at Arca, argued that the recent sell-off in crypto has been exaggerated. According to Dorman, there is no fundamental negative event driving the decline:

“MSTR isn’t selling, Tether isn’t bankrupt, DATs aren’t selling, Nvidia isn’t crashing, the Fed isn’t turning hawkish. All the alleged reasons for the crypto sell-off can be easily debunked.”

Dorman explained that part of the weakness is due to lack of liquidity. Major institutions such as Vanguard, State Street, BNY Mellon, JPMorgan, Morgan Stanley, and Goldman Sachs have not yet fully rolled out crypto products, limiting institutional liquidity inflows.

Conclusion

BitMine’s latest $70 million ETH purchase underscores how seriously the company is pursuing its goal of accumulating 5% of total Ether supply. Continuing to buy above average cost suggests a fully long-term strategy. Tom Lee’s updated Bitcoin forecast signals that despite short-term uncertainty, sentiment remains positive heading into Q1 2025. Although liquidity shortages and delayed institutional adoption may create near-term pressure, the aggressive actions of major players indicate that the market could strengthen over the medium to long term.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.