A major development has emerged in the tokenized asset (RWA) ecosystem. Canton Network has returned to the spotlight with a notable funding round despite the fading DAT narrative. Nasdaq-listed Tharimmune completed a $540 million private placement, led by DRW and Liberty City Ventures, and supported by the Canton Foundation, to establish the Canton Coin (CC) treasury.

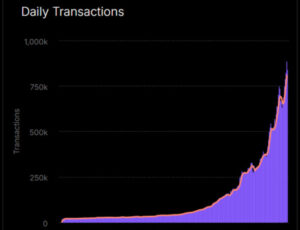

This investment represents not only a capital injection but also a renewed vote of confidence from traditional finance in blockchain technology. Canton is building the world’s first “AllFi” public chain, combining the strengths of DeFi and traditional finance. The network currently manages over $6 trillion in on-chain assets and averages 800,000 transactions per week.

Technology and Privacy-Focused Infrastructure

Canton’s technology stack is built on three main components Daml smart contracts, a Proof-of-Stake Hybrid (PoSH) consensus mechanism, and a synchronous domain name protocol. These components collectively deliver institutional-grade privacy, compliance, and transaction security.

- Daml smart contracts ensure that only relevant participants in multi-party transactions can view their own data.

- The PoSH model allows validators to verify only the information tied to the transaction itself.

This architecture is GDPR-compliant, addressing the data privacy and regulatory needs of major financial institutions. Through its “know-on-demand” model, Canton enables information sharing only when required maintaining both operational privacy and security against malicious actors.

Institutional Partnerships and Use Cases

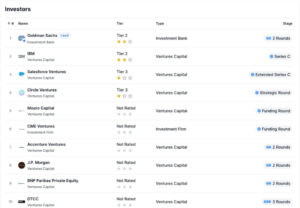

Canton Network has partnered with over 45 major financial institutions to facilitate the on-chain trading of real-world assets (RWAs) such as U.S. Treasury bonds.

Key partners include Bank of America, Société Générale, Citadel Securities, and Circle.

Through Canton’s infrastructure, these institutions conduct over $280 billion in daily repo transactions, underscoring its role as a real-time, 24/7 financial network bridging traditional finance and blockchain.

Tokenomics: Canton Coin (CC) and the “Mint-Burn” Model

Canton’s native token, CC (Canton Coin), operates under a unique mint-burn mechanism that doesn’t require staking. Validators and DApp developers earn CC through utility generation, and each newly minted token reflects network growth and transaction activity. Currently, the mint-burn ratio stands at 0.24, and as the network expands, this ratio is expected to produce a stronger deflationary effect.

Despite its institutional success, Canton faces regulatory hurdles. The U.S. SEC’s scrutiny of tokenized assets and the EU’s strict GDPR compliance requirements could affect its expansion pace. Some experts also caution that while the PoSH model enhances privacy, it may reduce transparency and introduce anti-money laundering (AML) risks.

The Rise of On-Chain Wall Street

With over $6 trillion in assets and half a billion dollars in funding, Canton Network is closer than ever to achieving its “on-chain Wall Street” vision. Its AllFi approach, merging DeFi and traditional finance, positions it at the core of next-generation financial infrastructure. Experts suggest that Canton’s strength lies not only in its technological innovation but in its ability to balance institutional trust with regulatory compliance making it a pivotal player in the future of tokenized finance.

Also, in the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube and Twitter for the latest news and updates