Mey Network is a blockchain-based ecosystem focused on tokenized real estate investments. Its mission is to democratize real estate ownership through tokenization, fractional ownership, P2P lending, and DeFi tools to create liquidity — all operating on its proprietary Layer-1 blockchain, Meychain, offering security, transparency, and scalability.

Project Vision

-

Break barriers in traditional real estate (high capital, geographic limits).

-

Convert physical assets into digital ones for increased liquidity and easy investor access.

-

Use smart contracts for transparency, traceability, and automation (rental distribution, voting rights, collateral management).

-

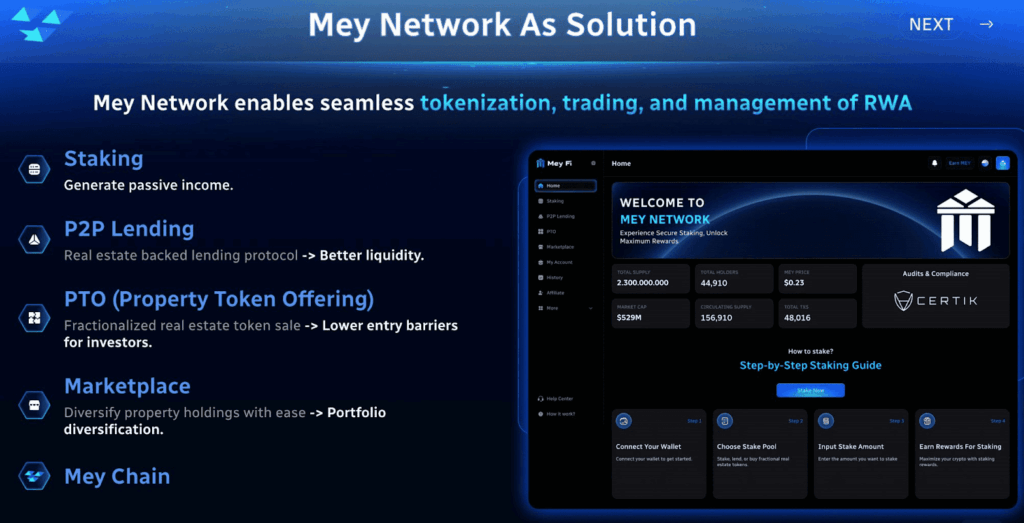

Provide a complete product suite — staking, P2P lending, and a marketplace — for both investors and developers.

Team

-

CEO — Danny Le: Master’s in Information Systems, blockchain expert, ex-military contractor, multiple startup founder.

-

COO — Steve Tran: Aerospace engineer with GameFi and Metaverse experience, connected to venture capital and Web3 projects.

-

CMO — Quyen Vu: 15+ years in corporate branding and communications (10 years in UK/Europe).

-

CTO — Kyro: 18+ years in tech, skilled in software, AI, QA, infrastructure, and GIS.

Investors & Strategic Partners

-

Alamat Capital: Investment and capital strategy.

-

PwC: Organizational and business model consulting.

-

BSI: Quality and information security standards.

-

RMA: International brand strategy management.

-

AWS: Cloud infrastructure optimization and security training.

-

VIUP: GIS integration and urban planning data access in Vietnam.

-

BIDV & PVcomBank: Banking service development.

-

Momo: Payment gateway and mini-app integration.

-

Blockchain Partners: Surgence, Polytrade, RealtyX, Synaps, Omni, BSCS, BinaryX, Kima, RWA.

How It Works

Meychain (Layer-1): Modular blockchain supporting RWAs with consensus, execution, asset integration, and storage layers. Cross-chain bridges enable interoperability.

MeyFi Platform (DeFi): Enables buying/selling tokenized properties, P2P lending, and staking for yield.

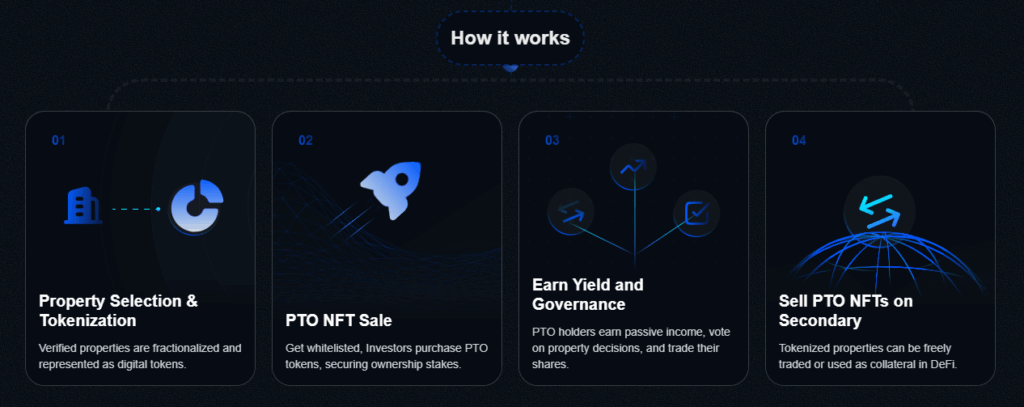

PTO (Property Token Offering):

-

Asset Selection & Tokenization: Physical properties are converted into fractional tokens/NFTs.

-

PTO NFT Sale: Whitelisted investors purchase NFTs.

-

Yield & Governance: Earn rental income and voting rights; tokens are tradable.

-

Secondary Market: NFTs can be freely sold or used as DeFi collateral.

Mey Passport: Grants early access to tokenized properties, VIP benefits, and governance privileges.

Mey Land (Coming Soon): Gamified, task-based platform that rewards community participation.

Governance

Mey Network operates as a Decentralized Autonomous Organization (DAO). MEY token holders can vote on proposals, upgrades, and strategies — shaping the ecosystem’s evolution collectively.

Roadmap

-

Phase 1 (Q4 2024): MeyFi launch — P2P lending, staking, PTO, marketplace, plus Mey Tap mini-game.

-

Phase 2 (Nov 2024 – Jul 2025): Meychain development — smart contracts, staking, governance, testnet & mainnet launch.

-

Phase 3 (2025): Global expansion — establishing offices in Dubai, Malaysia, and Thailand.

MEY Token

Utility Token: MEY powers the MeyFi platform but does not grant direct ownership of tokenized assets or NFTs.

Use Cases:

-

Staking for liquidity and APY rewards.

-

Exclusive access to VIP tiers, events, and perks.

-

DAO voting rights for ecosystem governance.

-

Discounts on marketplace fees (if applicable).

-

Bridgeable between Base and Meychain mainnet.

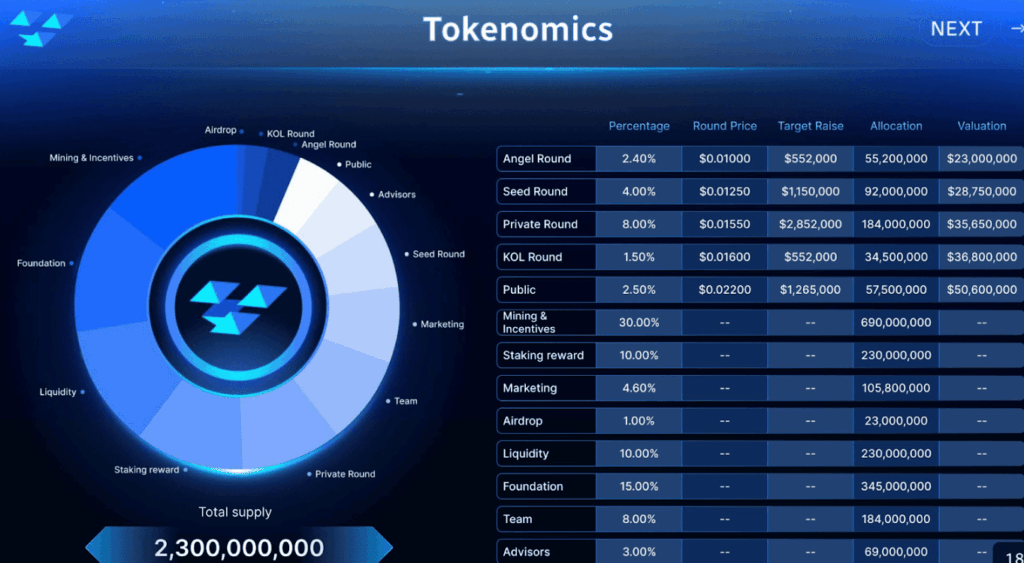

Token Details

-

Total Supply: 2.3B MEY

-

Circulating Supply: 284.3M MEY

Token Allocation

-

Angel Round: 2.85%

-

Seed Round: 3.55%

-

Private Round: 8%

-

KOL Round: 1.5%

-

Public Sale: 2.5%

-

Mining & Incentives: 30%

-

Staking Rewards: 10%

-

Marketing: 4.6%

-

Airdrop: 1%

-

Liquidity: 10%

-

Foundation: 15%

-

Team: 8%

-

Advisors: 3%

Ecosystem Components

-

MeyFi: DeFi suite (staking, P2P lending, PTO, marketplace).

-

Meychain: Layer-1 blockchain for RWAs.

-

Mey Tap: Gamified user acquisition tool.

-

Banking & Payment Partners: BIDV, PVcomBank, Momo.

-

Advisory & Compliance: PwC, BSI, Alamat Capital.

-

Technical Partners: CMC, AWS.

-

Community: Investors, developers, real estate professionals, local hubs.

Key Features

-

Tokenized RWA ownership via PTO.

-

P2P lending and collateralized property liquidity.

-

NFT-based staking rewards and ownership privileges.

-

Modular Layer-1 (Meychain) with validator nodes and bridges.

-

Compliance with ISO standards (BSI) and PwC consulting.

-

GIS integration via VIUP for spatial data access.

-

Marketplace tools for liquidity and property trading.

-

Gamification and educational engagement through Mey Tap.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.