SpaceX, the aerospace and technology company owned by Elon Musk, has sparked renewed market discussion by transferring more than $105 million worth of Bitcoin. On-chain data from Arkham Intelligence shows that the move reflects rising activity from the company’s wallets in recent months. The total transferred amount was 1,163 BTC, which was moved to two newly created, unmarked wallets. This has strengthened speculation that the company is restructuring its Bitcoin custody architecture.

Large-Scale Transfer: 1,163 BTC Distributed to Two New Wallets

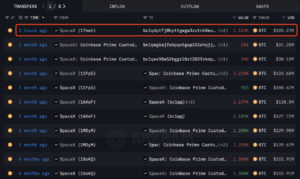

According to Arkham’s findings, SpaceX transferred a total of 1,163 BTC to two new Bitcoin wallets. The transfer details are as follows:

- 399 BTC → “bc1qh…galzy”

- 764 BTC → “bc1q4…u54ez”

This is the largest Bitcoin transfer made by SpaceX since October 29. Last month, the company moved another significant amount—281 BTC—to a different wallet. Many analysts believe that these on-chain movements indicate SpaceX is updating its Bitcoin custody structure, shifting away from hot wallets and transitioning to more secure, modern storage infrastructure.

SpaceX’s Bitcoin Portfolio: Over Half a Billion Dollars with 6,095 BTC

Arkham Intelligence’s detailed tracking data shows that SpaceX currently holds:

- 6,095 BTC

- With a total value of roughly $552.9 million

Due to the recent recovery in the crypto market, the dollar value of SpaceX’s Bitcoin reserves has increased substantially. While SpaceX’s Bitcoin position has long been a topic of debate, on-chain data confirms that the company still maintains reserves exceeding half a billion dollars.

Analysts: “This Is Not a Sell-Off — It’s a Custody Upgrade”

One of the first questions raised by the crypto community was whether the transfers were linked to selling pressure. However, on-chain experts emphasize that the movements do not signal selling activity. Instead, they indicate that SpaceX is migrating its Bitcoin to a more secure and modern storage setup.

Analysts highlight three key signals:

- Upgrading security infrastructure

- Updating wallet and custody structure

- Consolidating reserves

Since the funds were moved directly into fresh, unmarked wallets—not centralized exchanges—the transfer aligns with long-term storage goals rather than liquidation.

A similar picture can be seen at Tesla. Despite a major sale in 2022, the company still holds 11,509 BTC, worth approximately $1.05 billion. Together, Tesla and SpaceX hold tens of thousands of BTC, representing a significant institutional reserve presence in the crypto market.

Wallet Reactivated After Years of Silence — A New Phase May Have Begun

SpaceX-linked wallets became active again in late July after nearly three years of inactivity. Between July and November, the following movements were recorded:

- $153 million in BTC activity

- A major $268 million transfer

- Now an additional $105 million movement

This pattern of increasing activity strongly suggests that SpaceX has begun implementing a new custody strategy.

Overall Assessment

SpaceX’s $105 million Bitcoin transfer indicates that the company is not selling its BTC but rather strengthening its custody infrastructure. Experts describe the move as a security upgrade, wallet modernization, and reserve consolidation effort. The fact that the transfers went to new wallets and show no signs of exchange deposits supports this assessment. With 6,095 BTC in reserves, SpaceX continues to stand as one of the most significant corporate holders of Bitcoin in the crypto ecosystem.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.