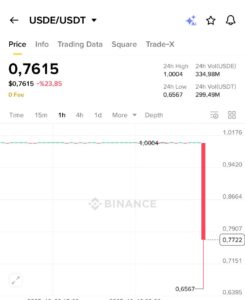

USDE, one of the largest stablecoins in the crypto market with a $14 billion market cap, lost its $1 peg during the recent severe market fluctuations. The event occurred immediately after U.S. President Donald Trump announced a 100% tariff on Chinese imports, triggering widespread panic across crypto markets.

Shockwaves Hit Stablecoins Too

The announcement led to massive sell-offs in global markets, and approximately $10 billion in crypto positions were liquidated. During this turmoil, USDE, the stablecoin of the Ethena ecosystem, briefly fell below $1, experiencing what is known as a “depeg.”

This sudden deviation caused concern among investors, raising questions about Ethena’s collateral structure and the sustainability of the system.

Official Statement from Ethena: “System Stable, Functions Operating Normally”

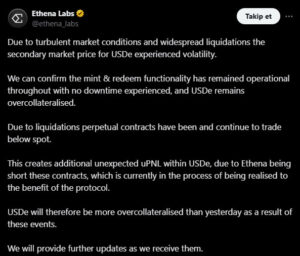

Following the incident, the Ethena team released a statement aimed at reassuring users. The protocol explained that USDE experienced short-term volatility in secondary markets due to sudden market movements and widespread liquidations.

Key points from Ethena’s statement:

- USDE’s minting and redemption functions continue to operate smoothly.

- The protocol remains overcollateralized, and the overall system security has not been compromised.

Ethena also noted that during the recent liquidation wave, futures contracts traded below the spot price, which had an unexpected effect on USDE’s unrealized profits. However, the protocol emphasized that realizing these positions will ultimately benefit the system in the long term.

“Increased Collateral Ratio Strengthens the System”

According to Ethena, the recent price volatility strengthened rather than weakened the protocol’s collateral structure. The team confirmed that USDE is currently more overcollateralized than the previous day, demonstrating that Ethena’s collateral management model remains resilient even under stressed market conditions.

Crypto analysts note that USDE’s brief depeg was caused by excessive selling pressure across the market and does not indicate a systemic issue. However, some experts argue that stablecoin projects should reassess collateral management risks during periods of high volatility.

Ethena Reassures Users as the Market Watches

Although USDE losing its peg created a stir in the stablecoin market, the Ethena ecosystem continues to emphasize the system’s security. The protocol reassures users that their assets are not at risk and will provide regular updates on developments.

As the crypto market remains volatile due to Trump’s trade policies, it will be closely monitored in the coming days whether USDE can fully regain stability.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.