Momentum (MMT) token drew significant attention after sharp price movements and large-scale transfers following its Binance listing. According to on-chain data, millions of dollars’ worth of MMT were transferred to Binance from a wallet linked to the project team. The rapid price surge and subsequent crash triggered strong reactions from the crypto community. Investors are now asking: “Why did MMT crash?”

Why Did MMT Drop? How Did Transfers Impact the Price?

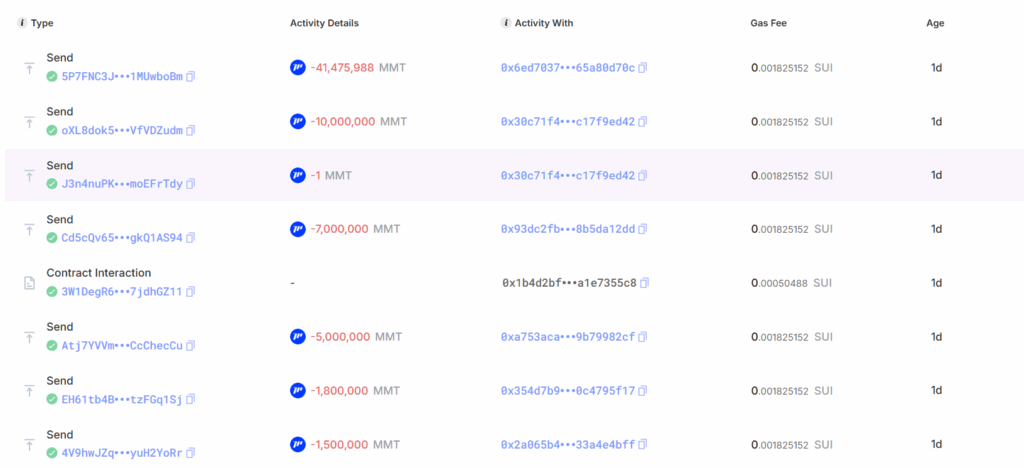

According to data shared by Suiscan, a wallet identified as 0xe7cd…7a88a4 and linked to the Momentum team sent 38 million MMT to Binance on November 5 at 16:00 (UTC+8). The transferred tokens were worth approximately $45.6 million. These funds originated from the second-largest MMT holder, wallet 0x1b4d2…7355c8, which controls 18.57% of the total supply.

This major wallet distributed 89.476 million MMT to 12 different addresses between November 4 at 18:41 and November 5 at 00:12 (UTC+8). Some of these addresses later sent tokens to centralized exchanges (CEXs). The timing of the transfers, occurring simultaneously with the Binance listing, immediately drew attention across on-chain analytics platforms.

Price Surge and Crash After Binance Listing

MMT started trading on Binance at $0.10. Within 12 hours, the token surged above $4.40, and on some platforms, brief spikes above $10 were recorded. However, the rally was short-lived. Shortly after, MMT price fell by 86%, dropping to around $0.59. Trading volume quickly increased, resulting in heightened volatility.

Why Did MMT Crash? On-Chain Data Reveals Key Factors

Several on-chain indicators point to the reasons behind the sudden decline:

-

The transfer of 38 million MMT to Binance created strong selling pressure.

-

The movement of a large portion of the supply into exchanges weakened market depth and affected liquidity.

-

After a rapid gain of over 1,300%, investors began taking profits.

-

The distribution of more than 89 million MMT to multiple addresses increased circulating supply in a very short time.

These data show that the price drop was not solely speculative but closely tied to token inflow into exchanges, increased circulating supply, and profit-taking behavior.

Impact of Whale Wallets on Market Sentiment

On-chain analytics platforms confirmed detailed movements from the second-largest wallet holding 18.57% of the total supply. The transfer of substantial token amounts to centralized exchanges exerted immediate downward pressure on the price chart. This shifted investor focus directly onto these wallets and raised concerns over insider activity and supply manipulation.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.