Strategy Firm Hints at New Bitcoin Investment

Michael Saylor, co-founder of the strategy firm, hinted that they would purchase more Bitcoin when traditional markets open on Monday. This statement drew attention especially amidst the tense geopolitical climate in the Middle East. Israel’s recent airstrikes on Iran have caused unease in global financial markets, while Bitcoin’s ability to maintain its value during this time reinforces investor confidence.

With the latest purchase on June 9, the firm acquired 1,045 BTC worth $110 million. This brings the total BTC holdings to 582,000. According to SaylorTracker data, the company has an unrealized capital gain exceeding 50%. This translates to a potential profit of approximately $20 billion.

Bitcoin’s resilience around the $105,000 level makes it increasingly viewed by investors as a “safe haven” amid global market stress. Despite the weekend’s military developments, the price only dropped by 3% and quickly stabilized.

Bitcoin Remains Strong Amid Rising Geopolitical Tensions

Experts warn that Iran’s potential closure of the Strait of Hormuz poses a serious threat to global energy markets. This strategic passage accounts for about 20% of the world’s oil supply. Any closure could spike oil prices and rattle financial markets. Rising energy costs can trigger a ripple effect across economic activity.

Nevertheless, institutional confidence in Bitcoin continues to grow. According to data from Farside Investors, Bitcoin ETFs saw capital inflows for the fifth consecutive day. The total weekly inflow exceeded $1.3 billion.

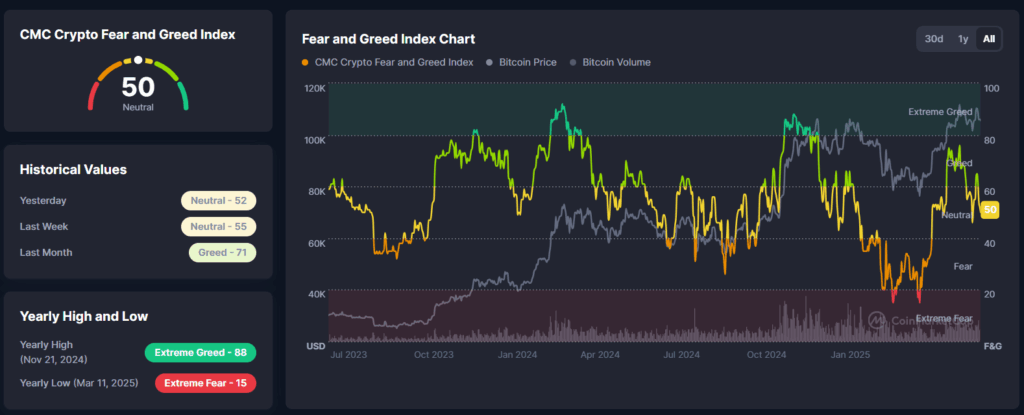

The Crypto Fear and Greed Index, which gauges investor sentiment, stands at 50. This level suggests a market dominated by “greed,” reinforcing belief in the bullish trend of digital assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.