The crypto markets kicked off July with increased ETF activity. On July 2, 2025, spot Bitcoin ETFs recorded a total of $407.8 million in net inflows, while spot Ethereum ETFs saw a net outflow of $1.9 million.

This highlights that institutional interest remains largely focused on Bitcoin.

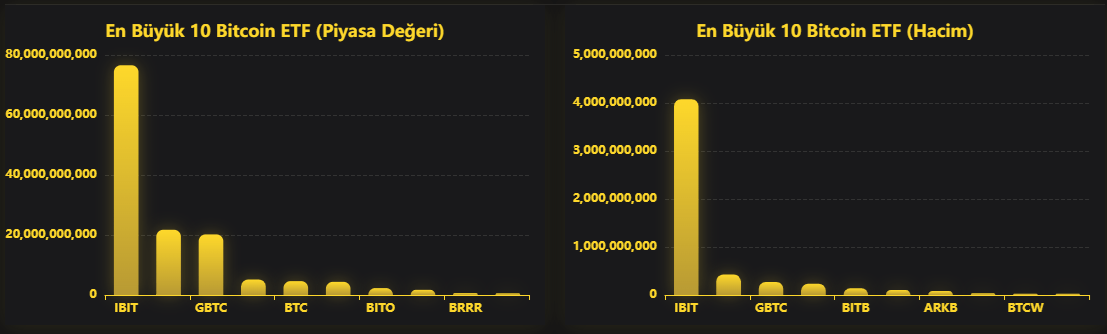

Strong Inflows into Bitcoin ETFs

As of July 2, the most notable inflows were as follows:

-

FBTC: +$184 million

-

ARKB: +$83 million

-

GBTC: +$34.6 million

-

BTC: +$16.5 million

-

BTCO: +$9.9 million

-

EZBC: +$9.5 million

-

HODL: +$5.4 million

Total net inflow: $407.8 million

These strong inflows indicate that spot Bitcoin ETFs are regaining investor confidence, with institutional capital flowing back into the market.

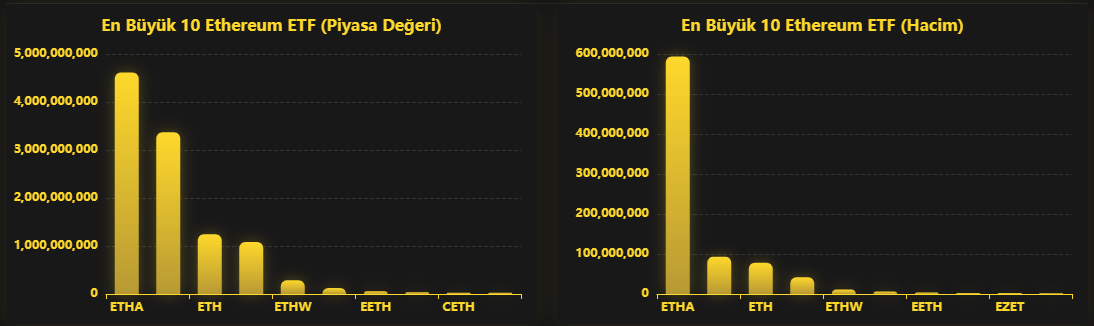

Modest Outflows from Ethereum ETFs

On the Ethereum side, the data paints a more cautious picture:

-

ETH: +$8.1 million

-

ETHW: +$8.3 million

-

ETHV: +$2.8 million

-

Other ETFs showed zero net movement.

In total, this results in a net outflow of $1.9 million across Ethereum ETFs.

This suggests that interest in Ethereum ETFs has yet to reach desired levels, with investors showing more caution compared to Bitcoin.

Where Is Institutional Interest Focused?

The data reveals a clear trend: growing institutional demand for Bitcoin ETFs, while Ethereum products still struggle to attract significant volume.

Key reasons behind this discrepancy include:

-

Bitcoin’s position as the market leader and its clearer regulatory framework

-

Institutional investors still favoring Bitcoin-focused strategies over alternatives

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.