The U.S. Department of Justice (DOJ) recently announced the seizure of 127,271 BTC, sending shockwaves through the crypto community. However, shortly after the announcement, a surprising movement was detected from a wallet linked to LuBian Mining Pool identified as the original owner of the seized Bitcoin.

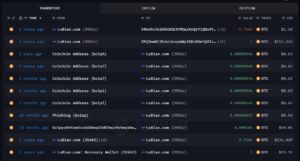

The wallet, which had remained dormant for nearly three years, suddenly transferred approximately 9,757 BTC (worth around $1.1 billion) to new addresses. This unexpected transaction has become a major topic of discussion among investors and blockchain analysts alike.

A Billion-Dollar Move After Three Years of Silence

According to on-chain tracking platform Lookonchain, LuBian’s “39DUz” wallet became active for the first time in three years, moving 9,757 BTC to several new wallets. What makes the event even more intriguing is its timing — the transfer occurred on the same day the U.S. government seized 127,000 BTC allegedly stolen from LuBian. This coincidence has led to widespread debate over whether the movement was a mere coincidence or a deliberate response to the DOJ’s action.

Experts note that while such large-scale blockchain transfers can be easily tracked, determining who actually controls the funds behind the transactions remains unclear.

LuBian and the Chen Zhi Connection

The LuBian mining pool emerged suddenly in 2020, rapidly becoming one of the largest Bitcoin mining pools at the time. However, it mysteriously disappeared after the theft of 127,000 BTC in December 2020. The stolen Bitcoin — worth around $3.5 billion at the time — was never fully traced, and the identity of the perpetrators remained unknown.

Yesterday, the U.S. Department of Justice (DOJ) filed a lawsuit against the Cambodia-based Prince Group and its chairman Chen Zhi.

According to the DOJ, Chen Zhi is accused of involvement in forced labor, fraud, and money laundering operations. The department also confirmed that the 127,000 BTC seized by U.S. authorities were the same coins stolen in 2020 from LuBian.

This revelation has reignited debate over whether the LuBian incident was truly a hacking theft or part of a larger-scale money laundering scheme.

Mysterious Movements Continue Across the Crypto World

Following the U.S. government’s seizure of 15 billion USD worth of Bitcoin, the sudden reactivation of the long-dormant LuBian wallet and the transfer of BTC to new addresses have sparked fresh speculation across the crypto market.

Experts remain uncertain whether this movement is linked to ongoing legal enforcement actions or represents a deliberate, coordinated transfer.

Such mysterious, high-value on-chain movements continue to draw the attention of investors and analysts alike — once again highlighting the importance of security, transparency, and traceability in the evolving digital asset ecosystem.