The sharp pullback in cryptocurrency markets, the drop in Bitcoin, and the resulting uncertainty in investor psychology have brought to light the fact that some analysts’ previously shared scenarios have largely come true. One such analyst is Sean Farrell, head of crypto research at Fundstrat. Following the significant realization of his December predictions, Farrell is now painting a more optimistic picture for the markets.

December Crypto and Bitcoin Outlook Played Out Almost Exactly

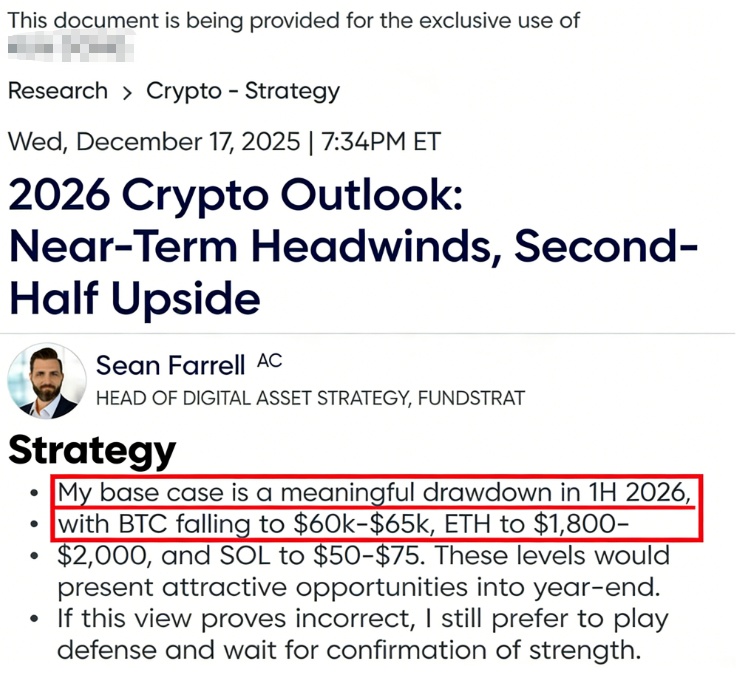

In a client note shared on December 17, 2025, Farrell warned that the first half of 2026 would be marked by sustained pressure across major digital assets. In that analysis, he projected that Bitcoin could retreat into the $60,000–$65,000 range before stabilizing. He also outlined downside targets for other large-cap assets, forecasting Ethereum to fall toward $1,800–$2,000 and Solana to correct into the $50–$75 band.

Recent price action has aligned closely with those projections. Bitcoin briefly touched the $60,000 level, Ethereum slipped as low as $1,747, and Solana traded down to around $67.5. The convergence between forecast and reality has reinforced Farrell’s credibility at a time when market sentiment remains fragile.

Tone Shifts Toward Opportunity

Following this corrective phase, Farrell has adjusted his outlook. In his latest remarks, the Fundstrat strategist argued that the balance of risk may soon begin to favor buyers rather than sellers. According to Farrell, the depth of the recent pullback has brought prices closer to levels that historically offered more attractive medium- and long-term entry points.

While he stopped short of calling an exact bottom, Farrell emphasized that the window for selective accumulation could be approaching. His view is based on the idea that much of the anticipated downside has already been absorbed by the market, reducing the asymmetry against new positions.

A Notable Contrast Within Fundstrat’s Orbit

An interesting contrast emerges when looking at Fundstrat’s broader leadership. Tom Lee, the firm’s founder and CEO, also serves as chairman of Ethereum-focused treasury company BitMine. Lee has taken a markedly different approach, backing aggressive accumulation rather than waiting for confirmation.

Over the past six months, BitMine has deployed roughly $16 billion into Ethereum. However, given ETH’s sharp decline, that position currently reflects around $8 billion in unrealized losses. The divergence between Farrell’s tactical caution and Lee’s conviction-driven accumulation highlights the tension between timing risk and long-term belief in crypto assets.

Overall, Farrell’s latest message suggests that while volatility remains elevated, the market may be entering a zone where strategic positioning becomes more relevant than outright risk avoidance.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.