November 2025 saw a major shift in the crypto venture capital market. According to RootData, 57 publicly disclosed investment deals took place during the month. This represents a 28% decrease from October’s 79 deals and a 41% drop compared to November 2024’s 96 deals. This decline in deal numbers contrasts sharply with the dramatic increase in total funding, highlighting the dominance of large, high-value investments.

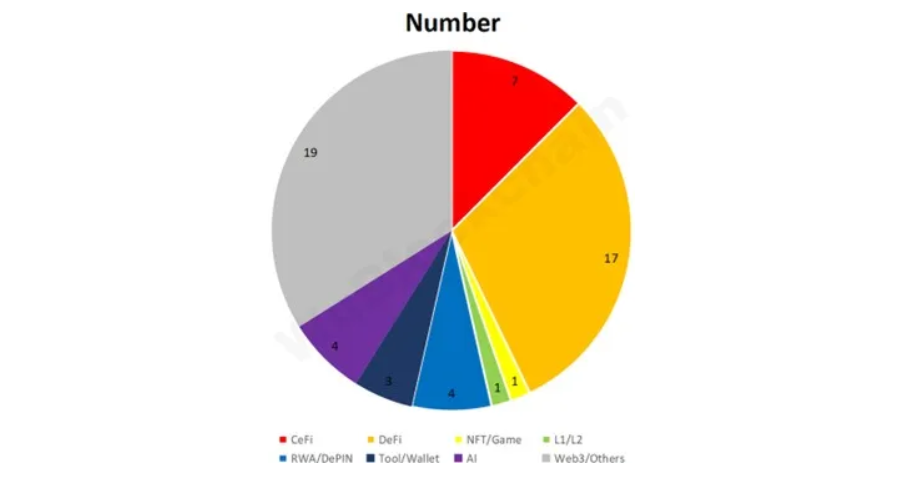

Investment Distribution by Sector

Investments were unevenly distributed across sectors. DeFi led with 30.4% of deals, followed by CeFi at 12.5%, RWA/DePIN and AI at 7.1% each, Tool/Wallet at 5.4%, and NFT/GameFi and L1/L2 at 1.8% each. This distribution indicates strong growth in financial infrastructure and AI-related projects.

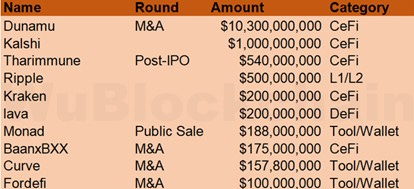

Key Funding Highlights in November

-

Naver acquired Upbit operator Dunamu in a share swap deal worth approximately $10.3 billion, marking the largest crypto funding event in history.

-

Prediction market platform Kalshi raised $1 billion, increasing its valuation to $11 billion, supported by Sequoia, CapitalG, Andreessen Horowitz, Paradigm, and Neo.

-

DRW Holdings and Liberty City Ventures initiated a $540 million private placement via Tharimmune Inc.

-

Ripple completed a $500 million funding round, raising its valuation to $40 billion.

-

Kraken received a $200 million strategic investment from Citadel Securities, bringing its post-money valuation to $20 billion.

-

BTC lending platform Lava secured an additional $200 million to expand BTC financial products.

-

Monad (MON) raised $188 million via Coinbase’s public sale.

-

Exodus Movement acquired W3C Corp for $175 million, financed with Galaxy Digital support.

-

Lloyds Banking Group acquired Curve digital wallet for approximately $157.8 million.

-

Paxos Trust Company acquired Fordefi Inc. for over $100 million.

These moves clearly illustrate the scale of the crypto market and investor preference for high-value projects. Naver’s Upbit acquisition and Kalshi’s valuation surge highlight strategic and speculative investment trends.

The surge in funding not only reflects VC investment trends but also shows corporate consolidation in the sector. Naver Financial’s acquisition of Dunamu signals a new era in Asia’s crypto-finance landscape. This deal may expand adoption and liquidity by merging crypto exchanges with traditional fintech players. Additionally, this massive liquidity influx could boost investor confidence and funding flow, stimulating growth in infrastructure, DeFi, Web3, and enterprise services, paving the way for further blockchain-digital finance integration.

Monad and Coinbase: Initial Token Sale and Market Launch

Monad launched its public sale on November 17, 2025, via Coinbase’s token sale platform. 7.5% of the total supply (7.5 billion MON) was offered at $0.025 USDC per token, giving the project a fully diluted valuation (FDV) of $2.5 billion.

Retail investors could participate with amounts ranging from $100 to $100,000 USDC. Additionally, Coinbase implemented a “filling up from the bottom” mechanism to prioritize small and medium investors over large ones.

Furthermore, immediately after the sale, on November 24, 2025, Monad’s mainnet went live, and tokens were distributed via airdrop. Approximately 10.8% of the total 100 billion MON supply was unlocked at launch, with 7.5% from the public sale and 3.3% via airdrop.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.