Economic developments such as interest rate decisions, inflation data, and employment reports play a decisive role in shaping global markets. However, taking direct positions on these data points has traditionally been possible only through expensive institutional terminals like Bloomberg or Refinitiv. Individual investors have often been left out of this process.

Opinion Labs stands out as a next-generation DeFi protocol aiming to change this dynamic. By transforming macroeconomic expectations and market sentiment into on-chain, tradable assets, the platform has also drawn attention due to a strong opinion airdrop expectation.

In this article, we examine what Opinion Labs is, how it works, and how to benefit from the Opinion airdrop opportunity.

What Is Opinion Labs?

Opinion Labs is an innovative protocol that combines decentralized prediction markets with an AI-powered oracle infrastructure. Its core objective is to convert macroeconomic expectations and collective market sentiment into transparent financial products accessible to everyone.

In short, Opinion Labs positions itself as an alternative to traditional financial terminals and is often described as the “Bloomberg of the People.”

Users can take direct positions on central bank decisions, inflation data, geopolitical developments, or other major macroeconomic events.

Opinion Stack: The Platform’s Technical Infrastructure

The Labs mainnet is built on the Opinion Stack, which consists of four core components:

Opinion.Trade

A live prediction exchange where users can create new markets, take YES / NO positions on existing events, and earn returns once outcomes are resolved.

Opinion AI

A decentralized AI oracle layer with a multi-agent architecture. It evaluates whether created markets:

-

Have objective rules

-

Can be resolved clearly

-

Are resistant to manipulation

These criteria are verified by AI.

Opinion Metapool

A unified liquidity layer that aggregates liquidity across different prediction markets, enabling deeper order books and more secure settlement.

Opinion Protocol

Provides a universal conditional token standard, enabling interoperability between different prediction markets.

This infrastructure aims to transform macro risks into a new digital asset class.

How Does Trading Work on Opinion Labs?

All trades on Opinion Labs are based on a simple question: “Will this event happen?”

Example Scenario:

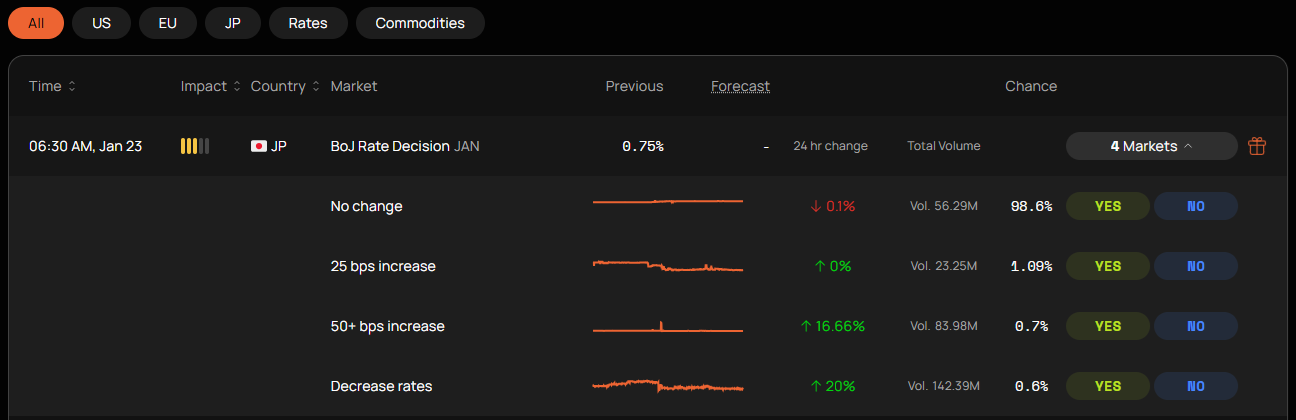

Bank of Japan (BoJ) Interest Rate Decision – January 23

Possible outcomes listed on the platform may include:

-

Rate cut

-

No change

-

25 basis point hike

-

50+ basis point hike

For each scenario:

-

YES / NO tokens are available

-

Tokens are priced based on probability

-

Trading volume and open interest can be tracked in real time

If a user believes the market is mispricing a scenario, they can take a position accordingly. Once the event is resolved, winning tokens are settled at 1 USD.

What Is the Opinion Airdrop?

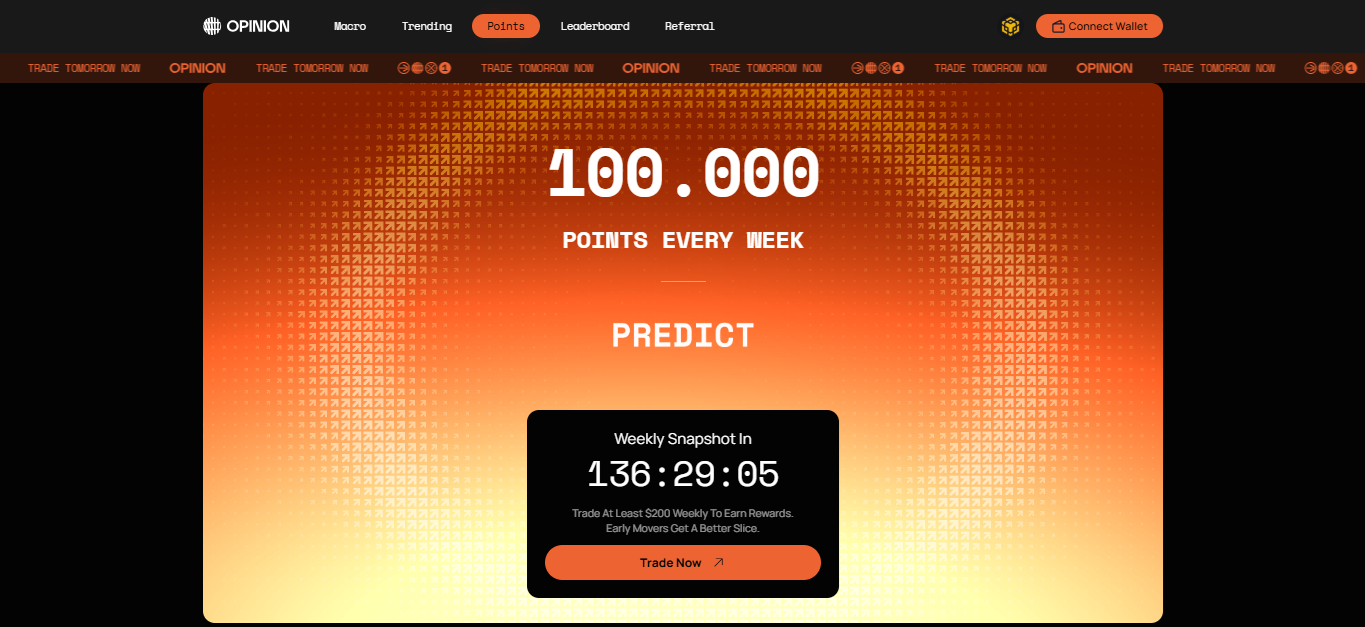

Labs has an active Points (PTS) system, which is widely considered the foundation for a potential opinion airdrop.

The platform’s slogan is clear: “Predict. Rise. Earn.”

Current system highlights:

-

100,000 PTS distributed weekly

-

Weekly snapshots

-

Early users receive higher relative rewards

-

Minimum $200 weekly trading volume requirement

Ways to Earn Points for the Opinion Airdrop

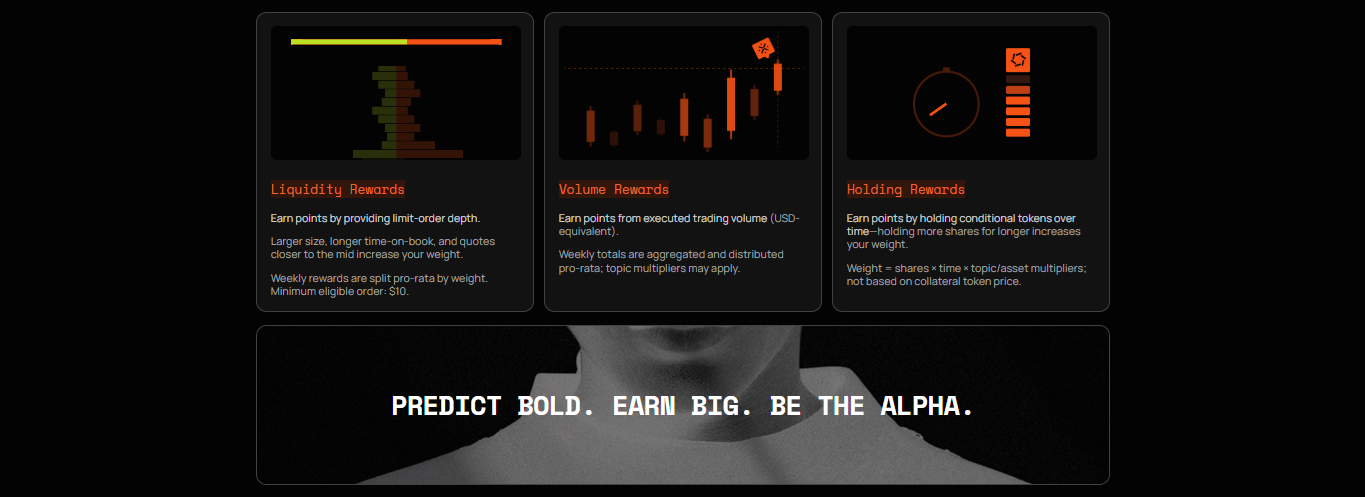

1) Providing Liquidity (Limit Orders)

The most effective way to earn points.

-

Liquidity is added via limit orders to the order book

-

Larger order size, longer duration, and proximity to the mid-price increase point weight

-

Minimum eligible order size: $10

-

Limit orders are explicitly incentivized over market orders

2) Trading Volume (Volume Rewards)

-

Points are awarded based on executed trading volume

-

Weekly volumes are aggregated

-

Points are distributed on a pro-rata basis

-

Certain markets may have additional multipliers

3) Holding Positions (Holding Rewards)

-

Holding conditional tokens over time generates additional points

-

Calculation formula:

Token amount × holding duration × market multiplier -

The price of the collateral token is not a determining factor

Long-term position holders gain an advantage under this system.

How Does the PTS System Work?

The PTS system is designed not only to reward trading activity, but also to improve market quality:

-

More accurate predictions

-

Higher-quality liquidity

-

Long-term participation

The point-to-token conversion ratio has not yet been announced. However, as seen in previous DeFi airdrop examples, expectations strongly favor a proportional distribution model.

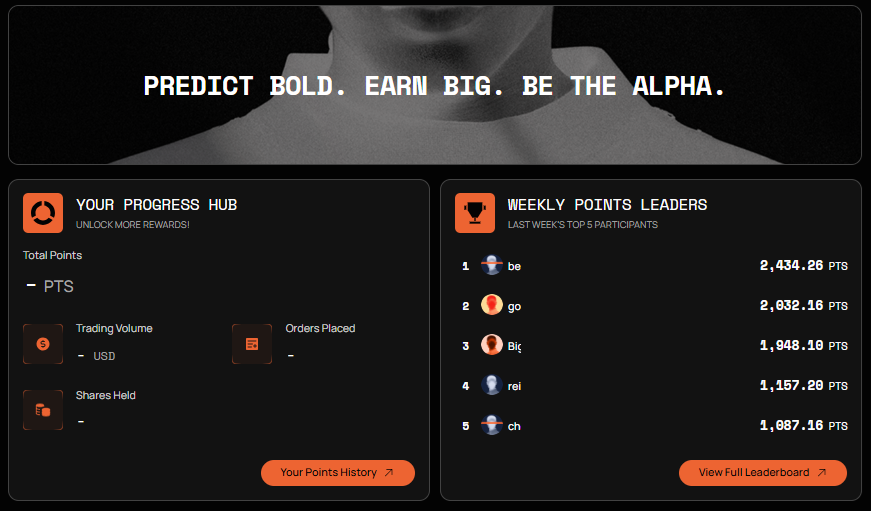

Where Can Points Be Tracked?

The user dashboard displays the following metrics:

-

Total PTS

-

Total trading volume (USD)

-

Number of orders placed

-

Conditional tokens held

These metrics are expected to be among the primary criteria for a potential Opinion airdrop distribution.

Why Is the Opinion Airdrop a Strong Expectation?

Opinion Labs is one of the rare and ambitious projects that combine macroeconomics with DeFi infrastructure. It is no longer at the concept stage; it already offers a working product, transparent incentives, and a clear points system.

Based on the current landscape, the likelihood of an Opinion airdrop continues to strengthen. Users who:

-

Open positions

-

Provide liquidity

-

Hold conditional tokens

gain advantages both within the PTS system and in a potential future token distribution.

Click here to start trading by opening a discounted Opinion account.

Looking at past DeFi examples, early contributors have often received proportionally larger allocations. For this reason, Opinion Labs stands out not only for those interested in macro prediction markets, but also for users closely tracking high-potential airdrop opportunities.

Official Links

You can join our Telegram channel to not miss the news and stay informed about the crypto world.