U.S. President Donald Trump’s announcement of a new bill that would allow the government to impose tariffs of up to 500% on countries trading with Russia has triggered a violent shockwave across cryptocurrency markets. The scope and potential impact of these tariffs accelerated the sell-offs in Bitcoin and altcoins, sparking renewed fears of a major correction.

Analysts warn that a tariff burden of this scale could affect not only traditional markets but also crypto directly—potentially causing an additional 10–20% drop in Bitcoin.

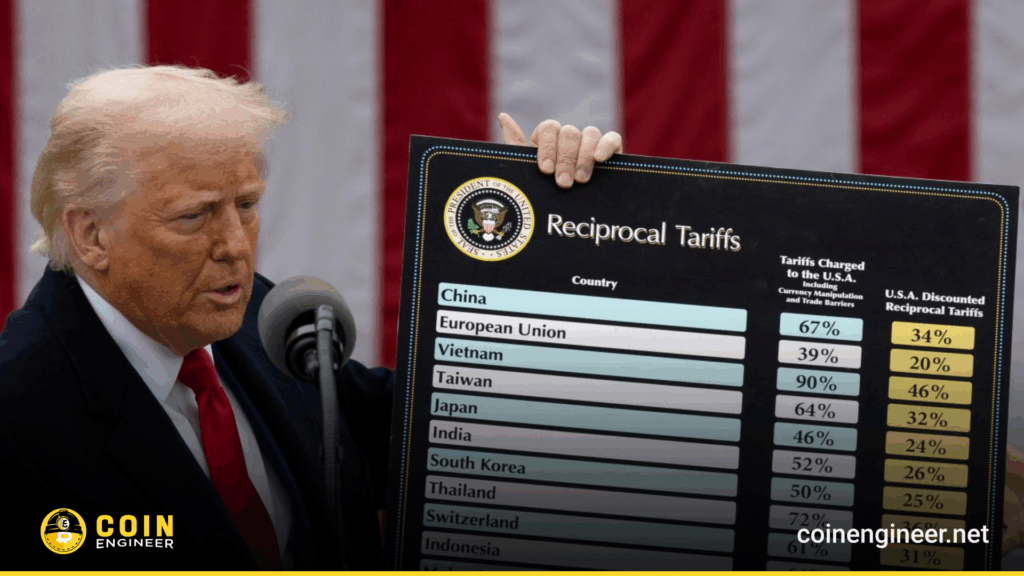

Trump’s Shock Bill: What Does a 500% Tariff Mean?

The proposed legislation would impose “punitive-level” customs duties on countries that continue importing goods or energy from Russia. Nations purchasing Russian oil and gas would be the main targets.

Senator Lindsey Graham described the logic behind the bill:

“If you buy from Russia and don’t support Ukraine, your goods will face a 500% tariff.”

Trump further emphasized that Republicans are preparing “very harsh sanctions” for any country doing business with Moscow. This is built on his previous tariff strategies, such as raising duties on India several times during his presidency signalling a potentially more aggressive trade stance ahead.

Immediate Market Impact: A Sharp Sell-Off

Following the announcement, the crypto market reacted instantly:

- Bitcoin fell to $94,000 (trading around $95,300 at the time of writing).

- More than $620 million in positions were liquidated in 24 hours.

- 152,000+ traders were wiped out.

- Hyperliquid recorded a $30.6 million single BTC-USD liquidation.

Ethereum retreated toward $3,000, while XRP, Solana, Cardano and other major altcoins saw rapid declines. Already fragile market sentiment turned even more pessimistic, amplifying the sell-off wave.

History Repeating? Why Tariff Shocks Hurt Crypto

Trump’s previous tariff announcements also shook global markets. During the U.S.–China tariff war:

- Over $200 billion was wiped from the crypto market in just days.

- Bitcoin dropped nearly 10% in a single day.

Analysts say this event is riskier because:

- The tariff is far higher (up to 500%),

- Its range is broader,

- It directly targets global energy and trade networks.

Thus, market fear is significantly greater this time.

Will Bitcoin Fall Further? Analysts Expect a 10–20% Drop

With rising macro pressure, analysts consider a new correction wave likely:

- If the bill progresses or gains Senate momentum, BTC could drop another 10–20%.

- Institutions and large traders are reducing exposure due to declining liquidity.

- Heavy leverage in the market increases liquidation-chain risk.

Investors are watching geopolitical risk and the Federal Reserve’s rate outlook closely.

A New Macro Storm for Crypto

Trump’s extreme tariff proposal creates a fresh wave of global uncertainty. A regulation targeting energy markets, global trade, and supply chains could:

- boost demand for the U.S. dollar,

- accelerate capital flight from risk assets,

- sharply increase volatility across all crypto markets, including Bitcoin.

The future direction of the market now depends on how the bill advances in Congress, Senate reactions, and global political responses.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.