September was turbulent for the cryptocurrency market. The wave of decline led by Bitcoin (BTC) triggered sharp losses in Ethereum (ETH) and many altcoins, and even whale investors could not escape the storm. On-chain data shows that large wallet holders resorted to panic selling, accepting millions of dollars in losses.

The recent turmoil in crypto markets has had a profound impact not only on prices but also on investor sentiment. Total liquidations have approached $1.7 billion, reaching one of the highest levels of 2025.

Ethereum, HYPE, and PUMP Whales Sell at Heavy Losses

According to analyses from blockchain data platform Lookonchain, several major whale addresses drew attention with poor timing. These sales further increased selling pressure in the market.

- Whale 0x3c9E sold 1,000 ETH for $4.19 million. However, this address is already known among investors as the “mistimed whale,” frequently buying high and selling low in the past—highlighting that even whales can make fear-driven mistakes.

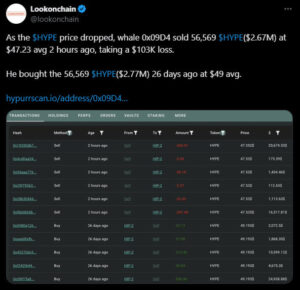

- Whale 0x09D4 sold around 56,569 HYPE tokens at $47.23, taking a loss of $103,000. This whale had purchased the tokens at $49 but decided to sell, anticipating a further decline. The move added additional selling pressure on HYPE.

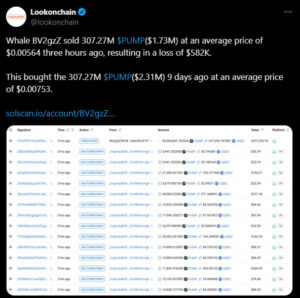

- Whale BV2gzZ dumped 307.27 million PUMP tokens just a few days after buying them. The tokens were sold at an average price of $0.00564, leaving the whale with a $582,000 loss. This once again highlights how extremely risky and volatile meme coins can be.

MrBeast’s Aster (ASTER) Investment Takes a Hit

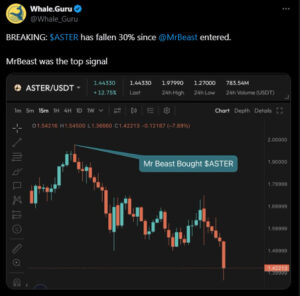

The turbulence in the crypto market hasn’t been limited to anonymous whales. World-famous YouTuber MrBeast faced disappointment shortly after supporting the Binance-linked decentralized exchange Aster (ASTER).

Although Aster’s token initially gained short-term attention due to MrBeast’s backing, it subsequently lost around 30% of its value. This demonstrates once again that celebrity endorsements don’t always lead to sustained price increases, and market fluctuations can catch even high-profile investors off guard.

What Do Panic Sales Mean?

Whale selling carries both negative and positive signals for the market:

- Negative side: When large wallets sell, it accelerates a loss of confidence in the market and creates a panic atmosphere among smaller investors.

- Positive side: According to analysts, these sales can help the market purge excessive leverage and move toward a healthier balance. Glassnode data shows that lower leverage reduces the risk of forced liquidations in crypto derivatives markets.

Whale Movements Teach Investors a Lesson

In the crypto world, “whales are not always smart money.” The recent wave of selling is one of the clearest examples. Even large investors can make fear-driven mistakes, making it critical for smaller investors to conduct their own research and prioritize risk management.

The chaos of September has once again demonstrated that crypto markets remain highly volatile and prone to speculation. Going forward, investors will be closely watching both Fed decisions and the next moves of whales.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.