Economist and gold advocate Peter Schiff has reiterated his preference for Bitcoin over Ethereum, even as BTC’s market dominance continues to decline. Schiff recently advised investors to convert their ETH holdings into BTC, noting that the strategy performed well until Ethereum’s strong rally last week.

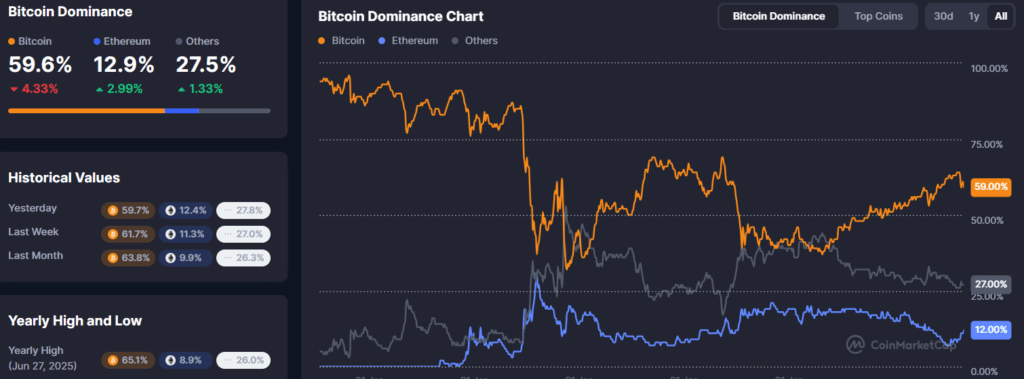

Ethereum’s surge past the $4,000 mark has significantly impacted Bitcoin’s dominance, which has fallen to 59.1%. According to CoinMarketCap, Ethereum’s market share has risen to 13%, while altcoins combined now hold 28% of the total market. A month ago, Bitcoin’s share stood at 63.9%, Ethereum at 9.7%, and other cryptocurrencies at 26.4%.

Schiff stated that if forced to choose between the two, he would pick Bitcoin, while clarifying that he has no personal interest in owning either asset.

Ethereum and Altcoins Gain Ground as BTC Weakens

Market data shows Bitcoin dominance has dropped by 4.91 percentage points in the last month, while Ethereum gained 3.34 points. Altcoins collectively rose by 1.57 points in the same period, signaling a capital rotation from Bitcoin to other cryptocurrencies.

Bitcoin’s highest dominance level in 2025 was 65.1% on June 27, while its lowest in the past year was 53.9% in December 2024. Ethereum, on the other hand, is trading near the upper range of its yearly performance.

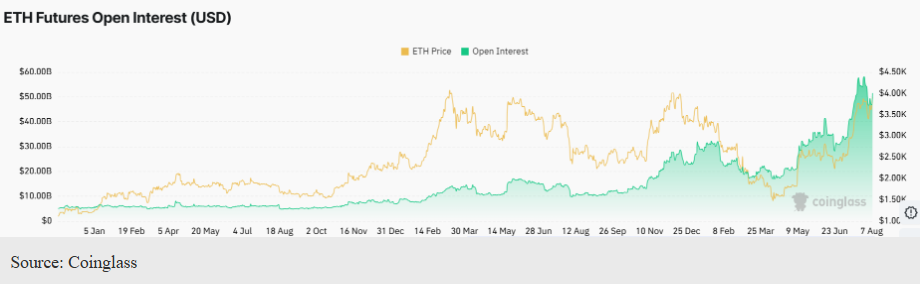

Ethereum’s bullish momentum has been fueled by increased whale transactions and heightened derivatives market activity. Rising trading volumes and open interest have reinforced short-term price strength, enabling ETH to outperform BTC in recent days.

Despite this shift, Bitcoin remains the largest cryptocurrency by market capitalization and the preferred choice among institutional investors. Strong demand from spot BTC ETFs and corporate treasuries continues to support its position at prices above $100,000.

In conclusion, while Ethereum and altcoins are gaining market share, Bitcoin still holds the lead. The next moves in dominance will likely depend on macroeconomic factors, institutional participation, and whether Ethereum can sustain its current rally.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.