Bitfinex-backed Plasma Blockchain has announced a major new initiative set to make waves in the crypto and finance sectors. The company is launching Plasma One, a platform designed to provide a next-generation banking experience specifically for stablecoin users. This venture stands out as the first neobank exclusively built for stablecoins.

Plasma One: An Alternative to Traditional Banking

As the stablecoin ecosystem has grown rapidly in recent years, many users still face difficulties using these assets in daily life. High transaction fees, slow transfers, and limited withdrawal options in traditional systems have created significant barriers.

Plasma One is designed to eliminate these issues, allowing users to utilize stablecoins seamlessly, quickly, and at low cost. Key features at launch will include:

- Zero-fee USDT transfers: Users can send USDT instantly and for free across the Plasma network.

- Rewards on card spending: Transactions made with stablecoins will provide users with additional benefits and rewards.

- Fast virtual card creation: Users can generate virtual cards within minutes and start using stablecoins for online purchases.

An early access program will initially target developing markets with limited access to dollars, enabling individuals with restricted banking services to benefit from stablecoin-based financial solutions.

Stablecoin Market Reaches Record Size

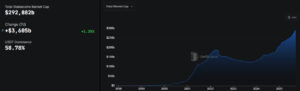

Stablecoins have become one of the most reliable pillars of the crypto market. Their total supply is approaching $290 billion, reaching all-time highs.

Experts predict that, supported by regulatory frameworks like the GENIUS ACT in the U.S., the stablecoin sector could exceed $2 trillion by 2028. This growth is driven by increasing stablecoin adoption among individual investors, central banks, and corporate entities.

Plasma aims to ride this growth wave not just with technical infrastructure, but through a vertically integrated financial product suited for everyday use. Plasma’s Head of Products, Murat Fırat, emphasized:

“Infrastructure alone is not enough. For users to truly use crypto in their daily lives, a vertically integrated product is required.”

Mainnet Launch and XPL Token

The announcement of Plasma One comes just days before the mainnet beta launch on September 25, which is expected to bring:

- A strong start with $2 billion in stablecoin liquidity,

- Extensive usage through 100+ DeFi integrations,

- Launch of the platform’s native XPL token.

The XPL token traded in pre-markets this summer with a fully diluted valuation (FDV) between $4.5 billion and $7.6 billion, highlighting investor interest and expectations.

What is Plasma (XPL)?

Stablecoins have become a key utility in the crypto ecosystem, with a market value exceeding $250 billion and trillions in monthly transaction volume. Plasma addresses these demands by offering:

- Zero-fee USDT transfers,

- Customizable gas tokens,

- Private payment support,

- High global transaction capacity.

Funding and Strategic Partnerships

Plasma raised $373 million in a 50-day token sale in July, with an additional $10 million in oversubscription commitments.

One of its major strategic moves was a partnership with Binance, launching the Plasma USDT locked product. Initially oversubscribed, the product was later expanded to $1 billion, aiming to boost stablecoin liquidity and strengthen the ecosystem ahead of the launch.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.