Michaël van de Poppe, the founder of MNFund and MNCapital and a well-known macro-focused market analyst, has shared a striking perspective on Bitcoin’s current valuation and market sentiment. According to Poppe, the present phase in the crypto cycle resembles only a few rare periods in history—moments that later proved to be exceptional long-term opportunities.

Bitcoin’s Fair Value Sits Far Above Its Bitcoin Price

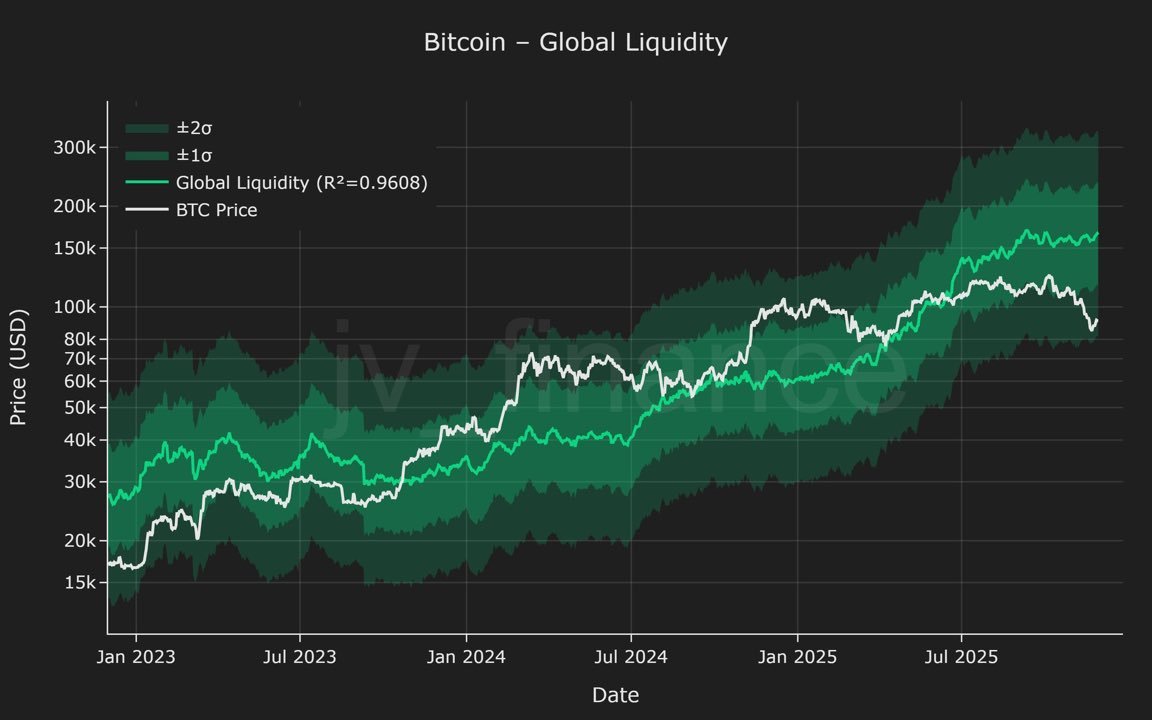

Poppe argues that when global liquidity conditions are taken into account, Bitcoin’s fair value stands at approximately 165,000 dollars. With BTC trading around the 90,000-dollar range, he describes the gap between intrinsic value and market price as one of the most significant mispricings seen in years.

The analyst notes that such divergences have appeared only during critical historical episodes, including the 2018 bear market bottom, the COVID-19 crash, and the aftermath of the FTX collapse.

Market Dominance Echoes the 2019 Structure

Another key point in Poppe’s assessment is Bitcoin dominance. He observes that dominance is tracking a downward trajectory similar to 2019 and has recently been rejected at the 20-Week Moving Average. Poppe expects this pattern to unfold once again, projecting continued decline in dominance heading into 2026. This, if realized, could signal a favorable environment for alternative cryptocurrencies.

A “Ghost Town” Phase Creates Accumulation Potential on Bitcoin

Poppe also describes the current market environment as unusually quiet—a “ghost town” stage marked by subdued enthusiasm and declining retail participation. He has witnessed this atmosphere only twice before: in the final stages of the 2019 bear market and during the early months of 2023. Both instances preceded strong recovery phases and turned into highly rewarding accumulation periods.

He believes today’s setup reflects a similar dynamic, offering meaningful opportunities for both altcoins and Bitcoin.

“This Cycle Is Not Over”

Despite widespread debate about whether Bitcoin has already peaked, Poppe rejects the notion that the cycle has concluded. He highlights the absence of key indicators typically associated with macro tops: retail mania, sharp overvaluation, or overheated market conditions. While commodities such as gold have experienced notable speculative surges, crypto markets show no comparable signs of excess.

For this reason, Poppe argues that calling a cycle top at this stage is premature.

Poppe’s broader outlook remains decidedly bullish. In his view, the market is far from exhaustion, and the quiet, undervalued nature of the current landscape may ultimately be remembered as one of the best positioning windows of the entire cycle.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.