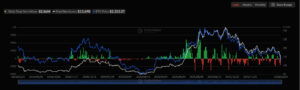

ETF flows in the cryptocurrency market are considered critical indicators for understanding the market direction and risk appetite of institutional investors. According to the latest data, Bitcoin and Solana ETFs recorded strong net inflows, while Ethereum and XRP ETFs saw limited outflows. This divergence indicates that institutional investors are pursuing a more selective strategy, focusing on specific assets rather than the broader market. Experts note that such ETF movements have the potential to shape market sentiment in the short term and influence price direction in the medium term.

Million-Dollar Inflows into Bitcoin ETFs

Recent data shows that Bitcoin ETFs recorded a total net inflow of $561.89 million. This strong capital inflow signals that Bitcoin has once again gained priority in institutional portfolios, indicating that investors are increasing their risk appetite in favor of the leading cryptocurrency under current market conditions. According to analysts, this trend confirms that Bitcoin continues to be positioned as a relatively safer and more liquid asset among institutional investors.

Limited Outflows from Ethereum ETFs

Ethereum ETFs recorded net outflows of $2.86 million. The relatively small size of these outflows suggests that there is no strong or widespread selling pressure on Ethereum, while indicating that investors are taking a more cautious stance in the short term. Analysts emphasize that long-term expectations for Ethereum remain intact, but risk management has become more prominent under current market conditions.

Low-Volume Movement in XRP ETFs

XRP ETFs experienced net outflows of $404.69 thousand. This limited movement suggests that institutional interest in XRP remains relatively weak and low in volume at this stage. Analysts note that this reflects a wait-and-see approach among investors, with no strong positioning taken until clearer market signals emerge.

Solana ETFs Stand Out Positively

Solana ETFs were among the day’s positive performers, recording net inflows of $5.58 million. This data shows that Solana continues to attract institutional interest among alternative layer-1 projects, while investors maintain their expectations regarding the network’s scalability and ecosystem growth. Analysts point out that these inflows indicate Solana’s continued positioning as a growth-oriented asset within institutional portfolios.

Assessment

ETF flows reveal that Bitcoin’s safe-haven perception has strengthened once again, while Solana is capturing a share of growth-focused institutional investments. The limited outflows in Ethereum and XRP highlight a balanced market environment characterized by cautious positioning. According to experts, ETF inflow and outflow data will continue to play a decisive role in determining price direction in the crypto market in the coming days.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.