Institutional investor interest in the cryptocurrency markets continues to be closely monitored through spot ETFs. According to data dated February 9, Bitcoin and Ethereum spot ETFs traded in the United States recorded renewed positive net inflows following recent periods of volatile price action. This development suggests that institutional players have not exited the market entirely and are instead viewing pullbacks as selective buying opportunities. In particular, the strong capital inflows into Bitcoin ETFs stand out as a noteworthy signal for overall market sentiment.

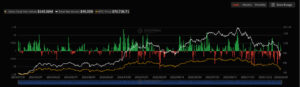

Million-Dollar Net Inflows Into Bitcoin Spot ETFs

According to the shared data, U.S.-listed Bitcoin ETFs recorded a total net inflow of $145 million on February 9. A significant portion of this capital was led by Grayscale, whose Bitcoin ETFs alone saw $131 million in net inflows. This picture indicates that despite recent volatility, institutional investor interest is once again gaining momentum. Analysts note that these inflows suggest recent pullbacks in Bitcoin’s price are being viewed by some investors as medium- to long-term buying opportunities.

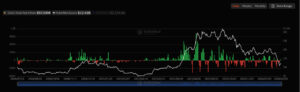

First Net Inflow in Ethereum Spot ETFs After Three Days

On the Ethereum side, a notable recovery signal emerged. Ethereum ETFs recorded net inflows of $57.05 million, marking the first positive flow after three consecutive days of net outflows. This development is interpreted as a sign that short-term selling pressure on ETH is beginning to ease, while institutional investors are once again turning toward cautious accumulation.

Modest but Positive Flow in XRP ETFs

As of February 9, XRP ETFs recorded net inflows of $6.31 million. Although relatively limited in size, this positive flow indicates that investors are maintaining a cautious but not entirely risk-averse stance toward XRP. Analysts suggest that despite price volatility and regulatory uncertainty, some investors continue to view XRP as a short-term opportunity and a portfolio diversification tool.

Net Outflows Stand Out in Solana ETFs

In contrast, ETF flows related to Solana diverged to the downside. According to the data, Solana ETFs recorded net outflows of $14.50 thousand. This trend suggests that investors are reducing risk exposure in more volatile assets like Solana in the short term and reallocating capital toward larger, more liquid markets such as Bitcoin and Ethereum. Analysts believe these outflows reflect a more cautious investor behavior during periods of heightened market uncertainty.

Assessment

The February 9 data points to total net inflows across crypto spot ETFs approaching $200 million. The movements observed in Bitcoin and Ethereum indicate that, despite short-term price fluctuations, institutional investors have not severed their ties with the market. Meanwhile, the more limited and divergent flows in XRP and Solana ETFs highlight a carefully managed risk appetite and continued asset-specific selectivity among investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.