Rayls is an advanced financial infrastructure blockchain designed to connect Traditional Finance (TradFi) with Decentralized Finance (DeFi). The project combines a compliant public EVM chain with high-performance private institutional blockchains to enable regulated asset tokenization, secure intra- and inter-market settlement, and programmable privacy controls. Rayls’ vision is to bring $100T of TradFi liquidity and the global banked population into DeFi opportunities.

Team and Founders

-

Marcos Viriato – CEO, Co-Founder – 25+ years in banking; former COO and Deputy CTO at BTG Pactual

-

Alex Buelau – CPTO, Co-Founder – 20+ years in engineering; serial blockchain founder; former Global Product Director at Siemens

-

CH Lopes – COO – 21+ years in banking; former Head of Operations at BTG Pactual

-

Dr. Jacob Mendel – Co-CTO – 20+ years in cybersecurity/DLT; former J.P. Morgan DLT Executive Director and State Street Cryptography Head; holds 23 patents

-

Mario Yaksetig – Head of Research – 15 years in applied cryptography; BIS Technology Advisor

Investors and Key Partners

-

Central Bank of Brazil (DREX pilot) – PoC for CBDC issuance and tokenized credit instruments

-

Núclea – Largest FMI in the Southern Hemisphere; tokenizes 10,000+ commercial receivables weekly; $50M+ on-chain settled

-

Cielo – Latin America’s largest payment acquirer; tokenized merchant settlement and credit-card receivables; ~800,000 daily payments targeted Q3 2025

-

J.P. Morgan Onyx/Kinexys – Ranked first in “Epic” benchmark for privacy-focused institutional blockchain solutions

Project Concept and Operation

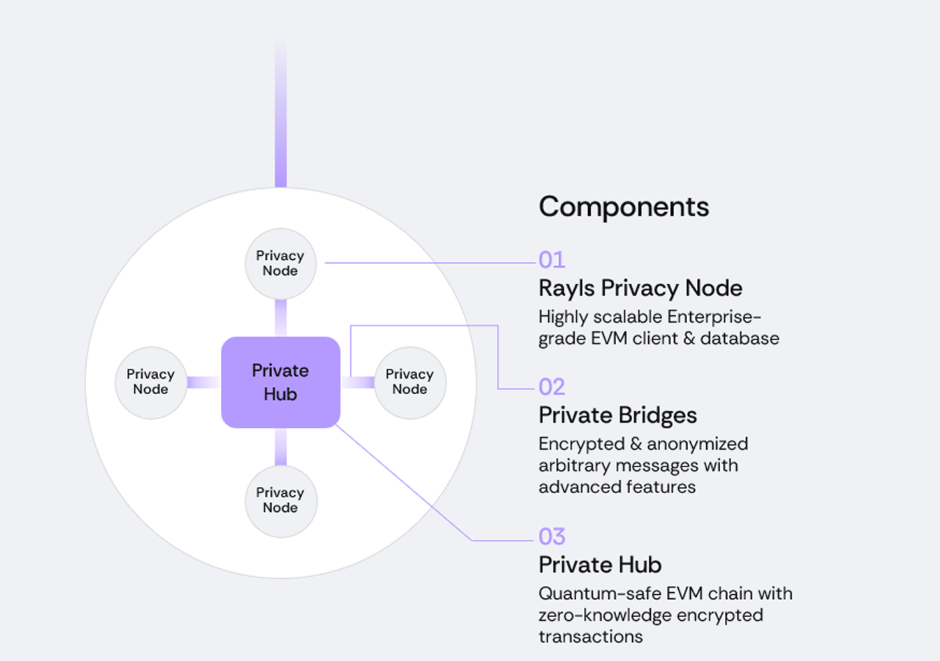

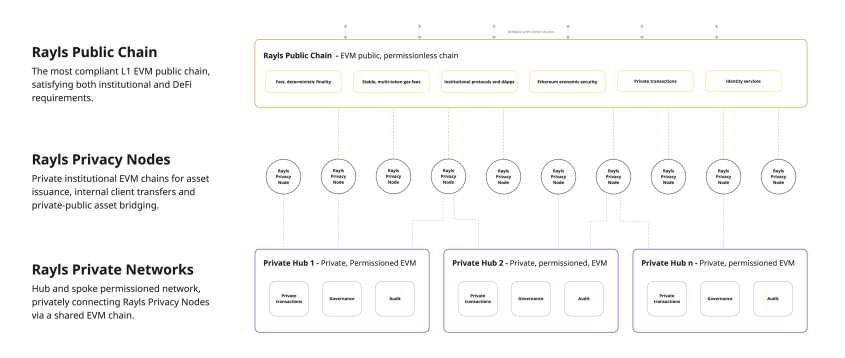

Rayls consists of two main components:

-

Rayls Public Chain: EVM-compatible, permissionless; all accounts KYC-verified; fully interoperable with DeFi protocols

-

Rayls Privacy Nodes: Private institutional blockchain infrastructure; banks and FMIs can deploy EVM chains

These systems together allow institutions to tokenize assets, distribute them on the public chain, and leverage DeFi protocols.

How Rayls Works

-

Asset Issuance & Internal Transfers: Assets tokenized within Privacy Nodes; high-volume workflows use POA RBFT consensus

-

Inter-Institution Transactions: Multiple Privacy Nodes form hub-and-spoke private networks, ensuring privacy, governance, and auditability

-

DeFi Access & Settlement: Public Chain brings tokenized assets and liquidity to DeFi; POSA RBFT consensus

-

Technology: High-performance Reth client; initial RBFT consensus, upgraded to Rayls Axyl (sub-second blocks, thousands TPS) in 2026

-

Privacy: Enygma protocol provides EVM-compatible privacy; ZKP ensures transaction integrity; selective disclosure for auditors

Governance

$RLS token holders participate in validator selection, protocol upgrades, and ecosystem grants.

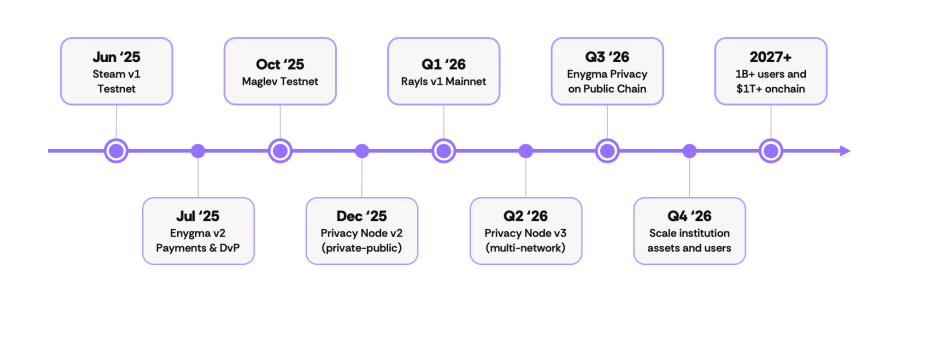

Roadmap

-

June 2025 – Steam v1 Testnet

-

Oct 2025 – Maglev Testnet

-

Dec 2025 – Privacy Node v2 (private-public)

-

Q1 2026 – Rayls v1 Mainnet

-

Q2 2026 – Privacy Node v3 (multi-network)

-

Q3 2026 – Enygma Privacy on Public Chain

-

Q4 2026 – Scaling institutional assets and users

-

2027+ – 1B+ users and $1T+ on-chain assets

Token Details – Rayls (RLS)

-

Total Supply: 10B RLS

-

Max Supply: 10B RLS

-

Circulating Supply: 0 RLS

Use Cases

-

Staking: Validators and delegators secure the chain and earn rewards

-

Governance: Token holders vote on protocol decisions

-

Transaction Fees: Paid in $RLS for institutional operations

-

Ecosystem Incentives: Grants, developer rewards, and liquidity incentives

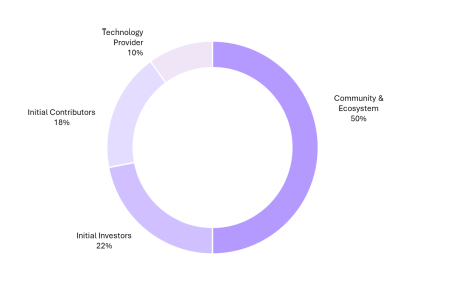

RLS Token Distribution

-

Community & Ecosystem – 50%

-

Initial Investors – 22%

-

Early Contributors – 18%

-

Technology Provider – 10%

$RLS Token Flow and Economics

-

All transaction fees, public or private, flow through $RLS, linking TradFi activity to DeFi demand

-

Public Chain Fees: Paid in $USDr → converted to $RLS; 50% burned, 50% to Rayls Foundation for validators and ecosystem

-

Private Chain Fees: Paid in $RLS; same 50/50 burn & distribution; fiat can be used via brokers

-

Transaction Fee Distribution: 33% validators, 33% Rayls Foundation, 33% ecosystem development

Flywheel Effect

Institutional usage → $RLS demand → staking & rewards → more ecosystem growth → reinforcing $RLS adoption

Proof of Usage (PoU):

Tracks private transactions and posts public records to ensure transparency and trust

Validators:

Secure network by validating transactions and ZKPs; require $RLS staking; rewards in $RLS; slashing for dishonesty

Features & Ecosystem

-

Privacy Node: Private EVM chains for asset issuance, client transfers, workflows

-

Private Network: Permissioned inter-institution network for governance & compliance

-

Public Chain: USD-pegged gas fees, fast finality, Enygma privacy, Ethereum security

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.