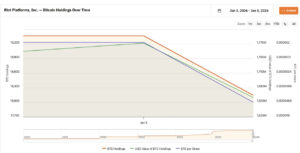

Riot Platforms announced that it sold Bitcoin worth $162 million after mining hash prices fell to low levels. With this sale, the company’s Bitcoin treasury declined from 19,368 BTC in November to 18,005 BTC. This move stands out as part of Riot’s strategy to both strengthen liquidity and balance operational costs. The cyclical weakness in hash prices has highlighted the company’s short-term cash needs and risk management priorities. These Bitcoin sales also demonstrate Riot’s flexibility in treasury management and its ability to adapt quickly to changing market conditions.

Sale Details and Impact

Riot reported an average Bitcoin sale price of $88,870, representing an approximate 8% decline compared to November’s average price of $96,560. Despite the lower price, total revenue from Bitcoin sales increased by 337% month-over-month, rising from $37 million in the previous period. The company emphasized that this sale marked only the third net reduction in its Bitcoin treasury for 2025 and represented its largest single monthly sale to date. Monthly Bitcoin production was reported at 460 BTC, reflecting an 8% increase compared to November’s 428 BTC, but an 11% decrease versus December 2024’s 516 BTC.

Hash Prices and Mining Profitability

The sale took place during a period of heightened pressure across the mining sector. Hash price—the expected daily revenue per terahash of mining power—remained near cycle lows for much of the quarter, creating a challenging profitability and risk environment for miners.

Despite this, Riot continued to expand its operational capacity. In December, utilized hashrate averaged 38.5 EH/s, up 5% from November’s 36.6 EH/s and 22% higher than December of the previous year at 31.5 EH/s. Average operating hashrate reached 34.9 EH/s. The company also reported using $6.2 million in power credits during December. These credits helped offset costs during periods of high grid stress by supporting demand response and energy curtailment programs in Riot’s operating regions.

Capital Strategy and Share Program

The Bitcoin sales coincided with changes in Riot’s broader capital strategy. The company restarted its at-the-market equity offering program, increasing the remaining capacity from approximately $150 million to as much as $500 million in potential share sales. Riot also announced that the December update would be its final monthly disclosure, with future operational and financial updates to be provided on a quarterly basis.

Other major miners pursued similar treasury management strategies in December. For example, CleanSpark sold 577 BTC, generating roughly $51.5 million in revenue. The Nevada-based company produced 622 BTC during the same period and held 13,099 BTC in its treasury as of December 31.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.