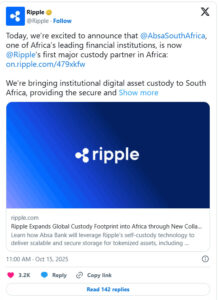

As part of its strategy to expand global crypto infrastructure, Ripple announced a strategic partnership with Absa Bank, one of South Africa’s leading banks. Through this collaboration, Ripple has secured its first major institutional crypto custody partner on the African continent.

This move comes at a time when digital asset custody and tokenization processes are gaining momentum. With this partnership, Ripple aims to provide compliant, secure, and scalable digital asset custody infrastructure to financial institutions across Africa.

Absa Bank: Africa’s First Ripple Custody Partner

By leveraging Ripple’s advanced custody technology, Absa Bank will offer its clients secure storage solutions for a variety of digital assets, including Bitcoin (BTC), Ethereum (ETH), and tokenized assets.

This initiative positions the bank to provide institutional clients with high-security digital asset management services, marking a significant step forward for crypto adoption in Africa.

Ripple’s Expanding Influence in Africa

Ripple’s entry into the African market goes beyond its partnership with Absa Bank. In recent months, the company launched its USD-backed stablecoin, Ripple USD (RLUSD), across the continent, and formed collaborations with leading fintech firms such as Chipper Cash, VALR, and Yellow Card. These initiatives demonstrate Ripple’s ambition to play a leading role in Africa’s financial digitization.

Ripple Custody has previously been adopted by major global banks including BBVA, HSBC, and DBS Bank, showcasing its proven institutional-grade custody solutions.

Sub-Saharan Africa has emerged as the third-fastest growing crypto market globally, with on-chain crypto transaction volumes exceeding $205 billion in the 2024–2025 period. Clearer regulatory frameworks in countries like South Africa and Nigeria are further fueling institutional interest in crypto.

The Absa Bank partnership positions Ripple as a key bridge in Africa’s digital financial infrastructure, enabling banks to digitize not only payment processes but also asset management through blockchain-based custody solutions.

Ripple, XRP, and Africa’s Digital Future

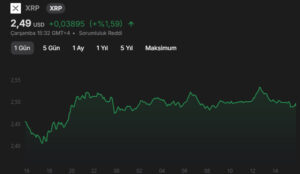

The price of XRP has responded positively to these developments, rising over 1% in the past 24 hours, trading around $2.50. Experts believe that Ripple’s institutional-focused strategy will continue to support XRP’s long-term value, reinforcing its role in the broader adoption of digital finance across Africa.

The partnership between Ripple and Absa Bank stands out as a historic development for both the XRP ecosystem and Africa’s crypto market. Rising institutional demand, regulatory clarity, and the ongoing tokenization trend all support Ripple’s long-term growth potential in the region.