Michael Saylor has once again reaffirmed his company’s unwavering commitment to Bitcoin, making it clear that Strategy has no intention of reducing its exposure. According to Saylor, the firm’s long-term roadmap remains intact regardless of short-term market volatility.

The company is not considering selling its holdings and plans to continue accumulating Bitcoin on a quarterly basis. This disciplined acquisition model underscores a strategic approach rather than a reactionary one.

Michael Saylor: “We Will Make Purchases Every Quarter”

Saylor emphasized that Strategy will keep purchasing Bitcoin every quarter, reinforcing its position as a long-term corporate holder. He also reiterated his belief that over the next four to eight years, Bitcoin could deliver returns that are two to three times higher than those of the S&P 500.

This outlook reflects Strategy’s broader thesis: Bitcoin is not simply a treasury reserve asset but a high-conviction, long-duration growth allocation.

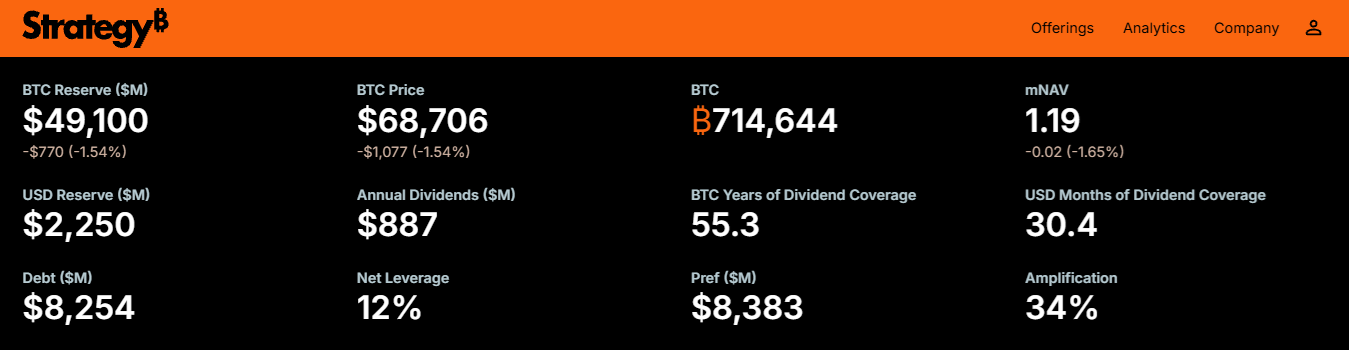

According to company data, Strategy currently holds 714,644 BTC. With an estimated market value of approximately $49 billion, this makes the firm the largest corporate Bitcoin holder globally. The scale of this position highlights the depth of Strategy’s commitment to its digital asset strategy.

Prepared Even for Extreme Downside Scenarios

Perhaps the most striking part of Saylor’s remarks concerned downside risk management. He stated that even if Bitcoin were to decline by 90% over the next four years, the company would not be forced to liquidate. Instead, Strategy would refinance its debt and extend maturities if necessary.

This suggests that the company’s capital structure is designed with high volatility in mind. Rather than being exposed to forced selling under stress, Strategy appears prepared to actively manage liabilities to maintain its Bitcoin holdings.

A Long-Term Capital Allocation Thesis

Strategy’s stance reflects a conviction-driven, long-term capital allocation framework. By committing to regular purchases and rejecting the idea of selling, the company positions Bitcoin as a core strategic asset rather than a tactical trade.

Despite ongoing market fluctuations, Strategy’s message is clear: its Bitcoin accumulation strategy is structural, not cyclical.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.