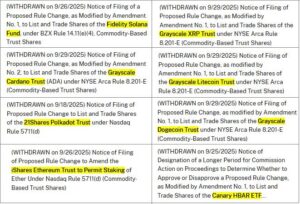

The U.S. Securities and Exchange Commission (SEC) has made a decision that has stirred the crypto market. The agency requested the withdrawal of 19b-4 ETF applications for XRP, Litecoin, Solana, Cardano, and Dogecoin.

This move signals that the 19b-4 forms, once a cornerstone of the ETF approval process, will now be replaced by a new framework. From now on, the approval process will proceed solely through S-1 registration filings.

Why Were 19b-4 Filings Important?

Closely followed by crypto investors, 19b-4 filings involved an exchange requesting permission from the SEC to list a new product — for example, an ETF. Each new ETF required a separate filing, and the process typically led to:

- Reviews lasting for months,

- Delays,

- Multiple rounds of feedback and resubmissions.

The SEC’s approval of general listing standards fundamentally changes this process. Exchanges can now list tokens that meet specific criteria under the same standard. This not only reduces bureaucracy but also makes ETF launches faster and more transparent.

What Changed for XRP and Altcoin ETFs?

XRP has long been seen as one of the strongest candidates for crypto ETF approval. With this new development, the process hasn’t been eliminated — only restructured. Now, XRP ETF approvals will rely on S-1 filings. These filings consist of detailed documents that provide investors with information about the ETF’s structure, risks, and specifications.

The same applies to Solana (SOL), Cardano (ADA), Litecoin (LTC), and Dogecoin (DOGE). Instead of separate applications, they will now be reviewed under a unified standard. This could allow the ETF process to move forward more quickly in the future.

Market Impact and Regulatory Perspective

Although this decision initially caused confusion among investors, experts view it not as a step backward but as a sign of maturation. The SEC’s new framework:

- Reduces bureaucratic burden,

- Addresses the need for regulatory alignment across institutions,

- Aims to provide a stable, long-term environment for crypto products.

Notably, the SEC is preparing to collaborate with the Commodity Futures Trading Commission (CFTC) on crypto regulation. An upcoming joint roundtable could mark the beginning of a more coordinated regulatory era for digital assets.

Expectations for the Future

Analysts believe this shift will make the process more flexible rather than cause delays. Previously, 19b-4 filings had strict deadlines, but now the SEC can review applications at any time. This could accelerate approvals while also leading to more unexpected announcement timings.

In the comment section, you can freely share your comments and opinions about the topic. Additionally, don’t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.