A sharp sell-off led by technology stocks on Thursday rattled global markets, dragging cryptocurrencies and precious metals lower as well. Rising volatility in U.S. equities and weakening earnings expectations pushed investors away from riskier assets. As risk appetite deteriorated rapidly, Bitcoin (BTC) fell below the $83,000 level, trading near prices last seen in April. The downturn in the crypto market occurred in parallel with declines in equities and metals, signaling a broad-based global risk-off move.

Sharp Decline and Liquidations in the Crypto Market

As the sell-off intensified, the total market capitalization of the cryptocurrency market dropped from around $3.1 trillion on Wednesday to just over $2.8 trillion, marking a nearly 6% decline. This move ranks among the most notable single-day drops since the major liquidation wave seen in October, when tariff threats from Donald Trump dominated the agenda. The loss of hundreds of billions of dollars in market value in such a short period highlighted how quickly investors exited risk assets.

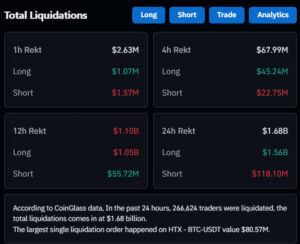

Alongside the price decline, liquidations accelerated sharply. According to Coinglass data, more than $1 billion worth of leveraged crypto positions were liquidated over the past 24 hours. The majority of these liquidations came from long positions closed during the downturn. In particular, hundreds of millions of dollars in positions were wiped out in the final hours, once again underscoring how fragile the market can be amid high leverage.

Altcoins and Market Breadth Remain Weak

Bitcoin’s pullback also weighed heavily on the altcoin market. Ethereum fell below $2,800, while major tokens such as Solana, XRP, and others recorded losses of around 5–6%. The widespread nature of the selling pressure reflected investors’ efforts to reduce risky exposure. Market breadth was already weak prior to the sell-off; according to Ryan Rasmussen, only a small number of the top 20 cryptocurrencies posted positive performance last week. This underscores that gains have not been broad-based and that downside pressure dominates much of the market.

Reversal in Tech Stocks and Precious Metals

Weakness in crypto closely followed sharp losses in U.S. equities. Disappointing earnings in the technology sector intensified selling pressure. Microsoft posted one of its worst daily performances since March 2020, dragging down both the Nasdaq and the S&P 500. This deterioration in tech stocks made the global risk-off sentiment even more pronounced.

Precious metals showed a similar pattern. After reaching consecutive record highs in recent weeks, gold and silver pulled back sharply as investors reduced positions in risk assets. This reversal suggests that the safe-haven narrative weakened in the short term, with markets instead entering a broad de-risking phase.

Washington-Driven Risks in Focus

The market sell-off coincided with rising political uncertainty in Washington, D.C. Renewed concerns over a potential U.S. government shutdown further strengthened investors’ risk-averse stance. Data from prediction markets supports these worries: contracts traded on Polymarket now imply a 68% probability of a U.S. government shutdown. Historically, similar periods of uncertainty have placed additional pressure on Bitcoin and other risk assets. Analysts warn that if political risks persist, market volatility may remain elevated and investors could maintain a cautious posture.

Risk-Off Sentiment Weighs on Markets

Overall, the picture points to a broad risk-off movement across global markets. Bitcoin and the wider crypto market have been negatively affected alongside technology stocks and precious metals, while rapid liquidations of highly leveraged positions have further amplified volatility. In the days ahead, macroeconomic developments and political risks are expected to remain key drivers of market direction.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.