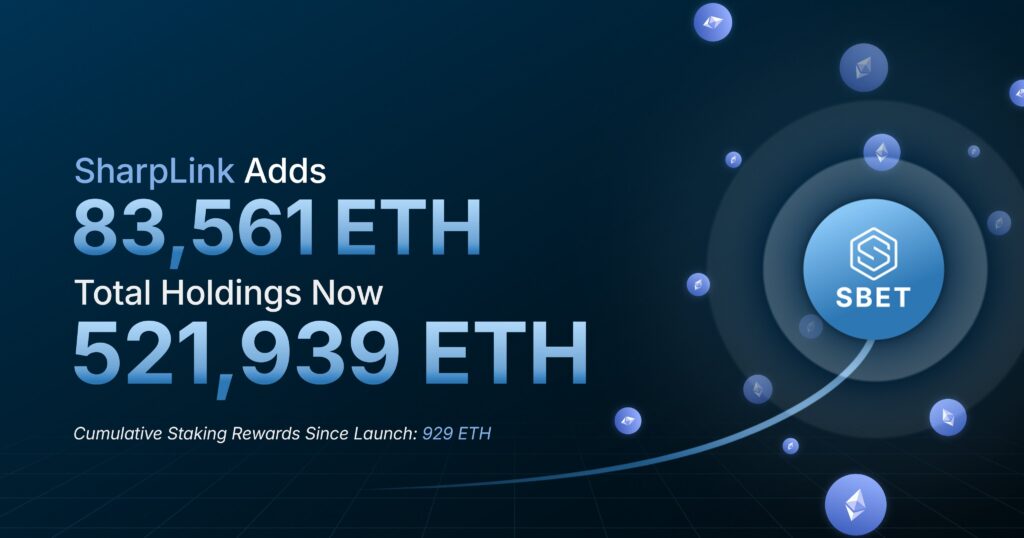

One of the most notable institutional moves in the crypto markets this week came from SharpLink Gaming. Continuing its aggressive investment strategy toward Ethereum, the company expanded its portfolio by purchasing 83,561 ETH between July 28 and August 3, 2025. The transaction, valued at $264.5 million, was executed at an average price of $3,634 per ETH.

SharpLink’s total ETH holdings have now reached 521,939 ETH, making it one of the largest Ethereum-holding public companies. Additionally, the “ETH Concentration”—defined as the ETH per share ratio—rose from 3.40 to 3.66 this week. Since the start of this strategy on June 2, 2025, the ratio has increased by 83%.

Just recently, SharpLink had already attracted attention with its significant purchase during the July 28 – August 3 period. Acquiring 83,561 ETH at an average price of $3,634, the company significantly expanded its portfolio. The total value of the investment reached $264.5 million. In just one week, SharpLink added over 100,000 ETH to its reserves, clearly demonstrating its strong confidence in Ethereum. As a result of this aggressive strategy, the company’s total ETH holdings have surpassed 520,000.

What’s even more striking is that the company stakes its entire ETH holdings. Through this strategy, SharpLink has so far earned 929 ETH in accumulated staking rewards. The company’s long-term HODL approach combined with an active staking policy sets it apart from many competitors in the industry.

Additionally, these Ethereum investments are indirectly accessible via the company’s publicly traded shares under the ticker symbol $SBET. This development makes $SBET even more appealing to both individual investors and institutional analysts.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.